Introduction to Trend Analysis Using Moving Averages

Trend analysis is a fundamental method used in technical analysis to forecast the future direction of an asset, such as a stock, based on its past data. One of the most common ways to conduct trend analysis is using moving averages. Moving averages are statistical calculations that analyze data points by creating series of averages of different subsets of the full data set.

Understanding Moving Averages

A moving average (MA) is a widely used indicator in technical analysis that helps smooth out price action by filtering out the “noise” from random short-term price fluctuations. It is a trend-following, or lagging, indicator because it is based on past prices.

Types of Moving Averages

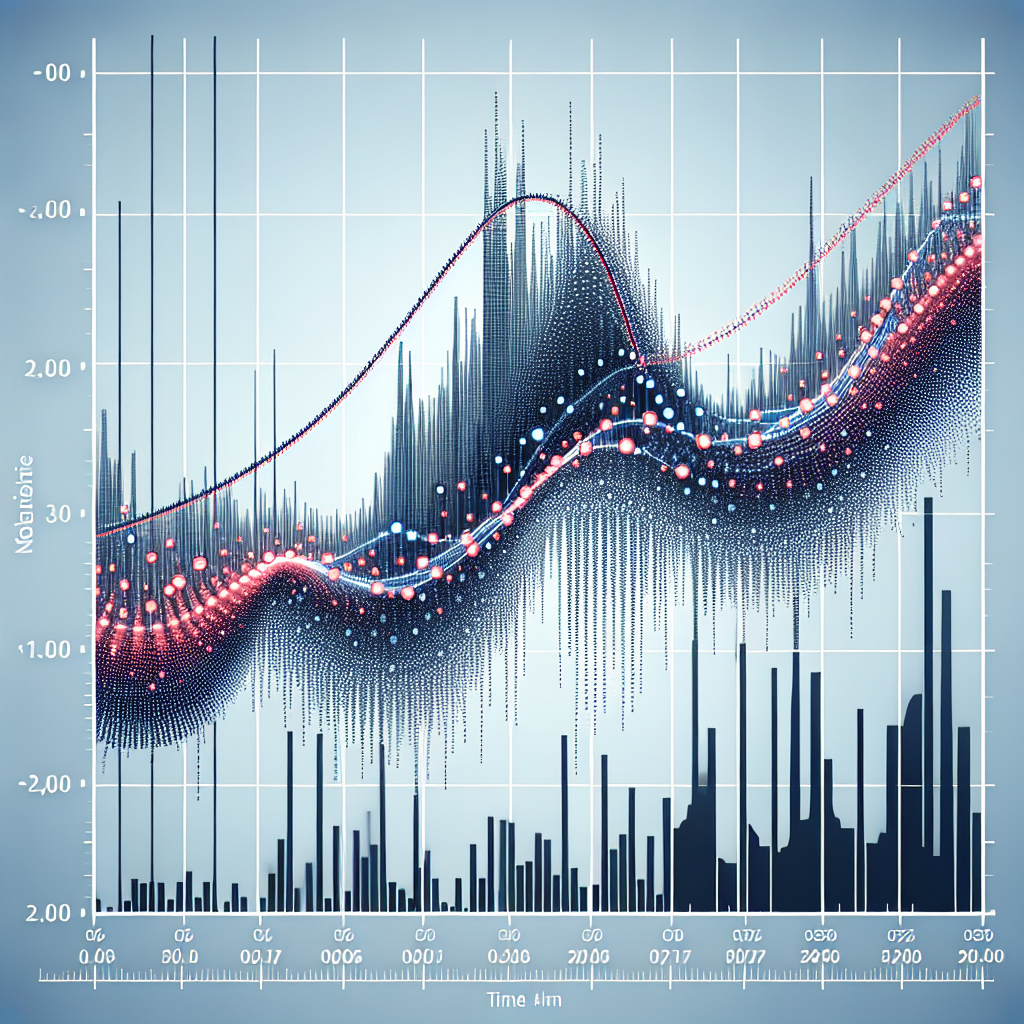

There are two main types of moving averages: simple moving averages (SMA) and exponential moving averages (EMA). The SMA calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range. The EMA gives more weight to the most recent prices, and therefore reacts more quickly to price changes than the SMA.

Using Moving Averages in Trend Analysis

Moving averages can provide a clear view of the price trend of a security by eliminating the day-to-day price fluctuations, making it easier for traders and investors to interpret the price signals.

Identifying Trends

A moving average can help cut through the noise and identify the overall direction of the trend. For an uptrend, the price should be above the moving average line and for a downtrend, the price should be below the moving average line.

Signal Generation

Moving averages can also generate trading signals. This is typically done by using two different periods, such as a short-term and a long-term moving average. A buy signal is generated when the short-term average crosses above the long-term average, while a sell signal is generated when the short-term average crosses below the long-term average.

Limitations of Moving Averages

While moving averages can be powerful tools, they are not without limitations. Because they are lagging indicators, they can often be late in generating signals, potentially causing traders to miss significant moves. Additionally, they may not be as effective in volatile markets where price fluctuations can result in frequent, false signals.

Conclusion

Trend analysis using moving averages can be an effective way to identify and trade in line with the overall market trend. However, like all technical analysis tools, it is important to use them in conjunction with other forms of analysis to increase the chances of success.