Introduction to Elliott Wave Analysis

Elliott Wave Analysis is a form of technical analysis that traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Named after Ralph Nelson Elliott, who discovered the underlying social principles and developed the analytical tools in the 1930s, Elliott Wave Analysis is still a popular method used in trading.

The Basic Principles of Elliott Wave Analysis

Elliott Wave Analysis is based on several key principles. These principles create a framework for predicting market behavior.

Wave Principle

The Wave Principle is the cornerstone of the Elliott Wave Analysis. It states that market prices unfold in specific patterns, which traders have termed “waves”.

Fibonacci Sequence

The Fibonacci sequence plays a significant role in Elliott Wave Analysis. The sequence’s numbers are used to calculate wave patterns and predict future prices.

Fractal Nature

Elliott Wave Analysis also recognizes the fractal nature of the financial markets. A fractal is a complex pattern where each part of the structure has the same character as the whole.

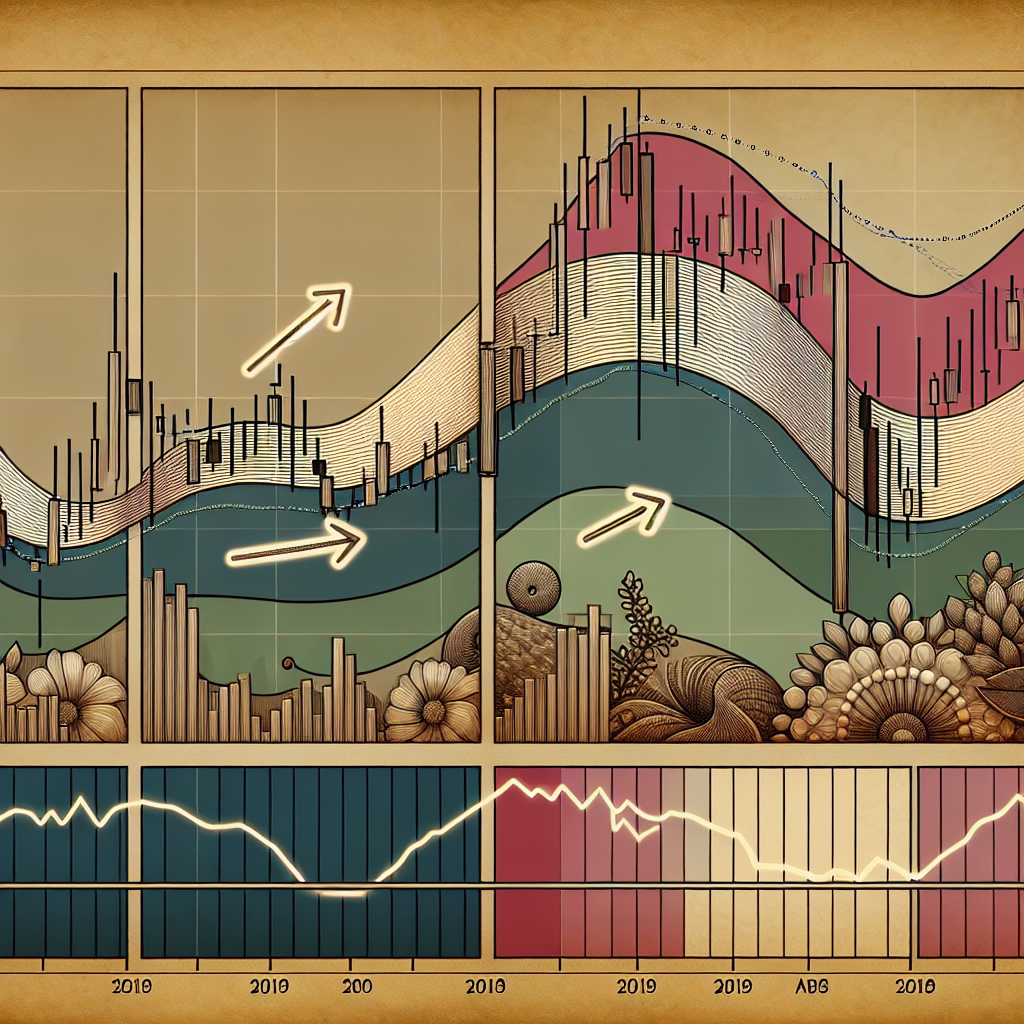

Understanding the Elliott Wave Patterns

There are two types of wave patterns in the Elliott Wave Analysis: Impulse Waves and Corrective Waves.

Impulse Waves

Impulse waves consist of five sub-waves that make net progress in the same direction as the trend of the next larger size. These waves are labeled as 1, 2, 3, 4, and 5.

Corrective Waves

Corrective waves are waves that move against the trend of one larger degree. These waves consist of three sub-waves and are labeled as a, b, and c.

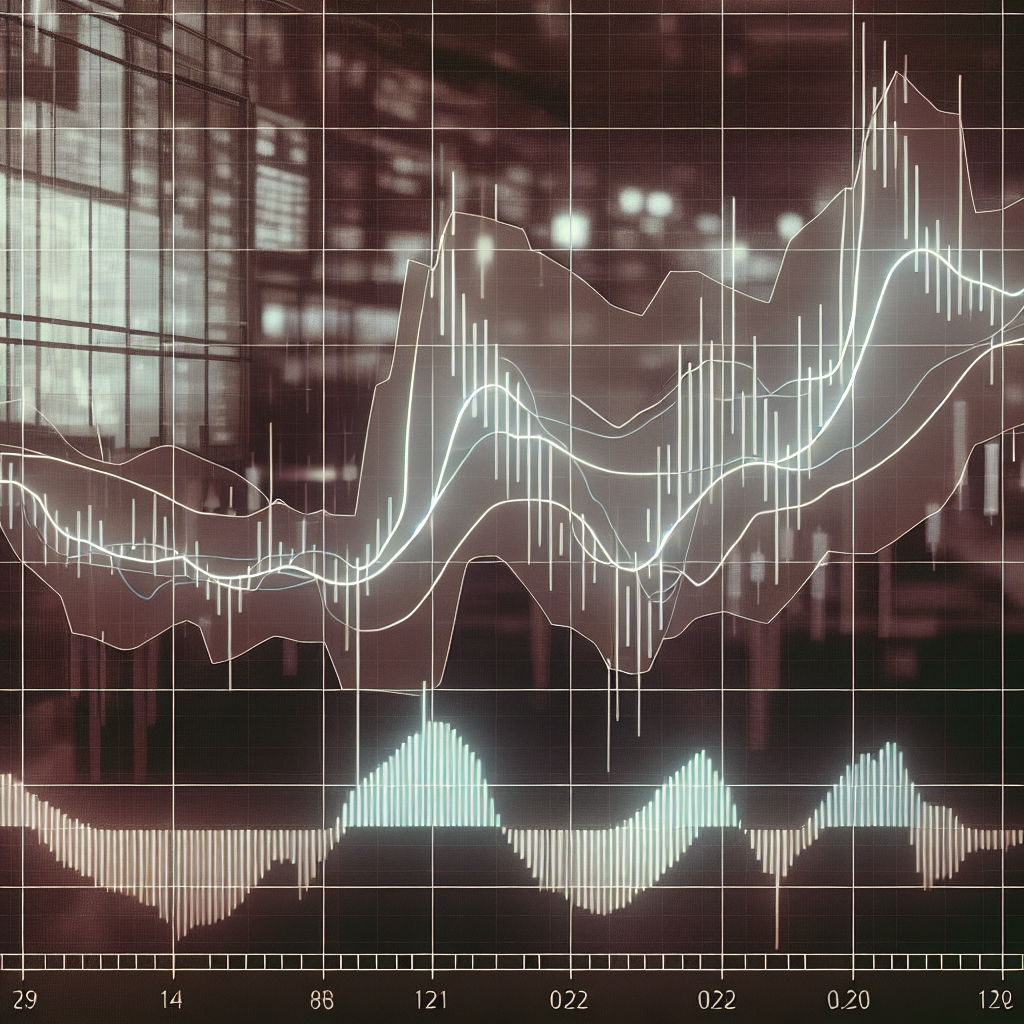

Applying Elliott Wave Analysis

To apply Elliott Wave Analysis, traders follow a series of steps to identify potential wave counts and make predictions.

Identify the Wave Count

The first step is to identify the wave count. This involves looking at price data and identifying patterns that represent the wave sequences.

Apply the Fibonacci Sequence

Next, traders apply the Fibonacci sequence to the wave count. This helps them predict the potential highs and lows of future waves.

Use the Wave Principle

Finally, traders use the wave principle to predict future market behavior. This involves understanding the patterns that the waves form and how they can indicate future price movements.

Conclusion

Elliott Wave Analysis is a powerful tool for predicting market trends and price movements. By understanding the principles and patterns of this analysis method, traders can make more informed decisions and potentially increase their profits. However, like all trading strategies, Elliott Wave Analysis is not foolproof and should be used in conjunction with other forms of analysis to ensure the best possible trading decisions.