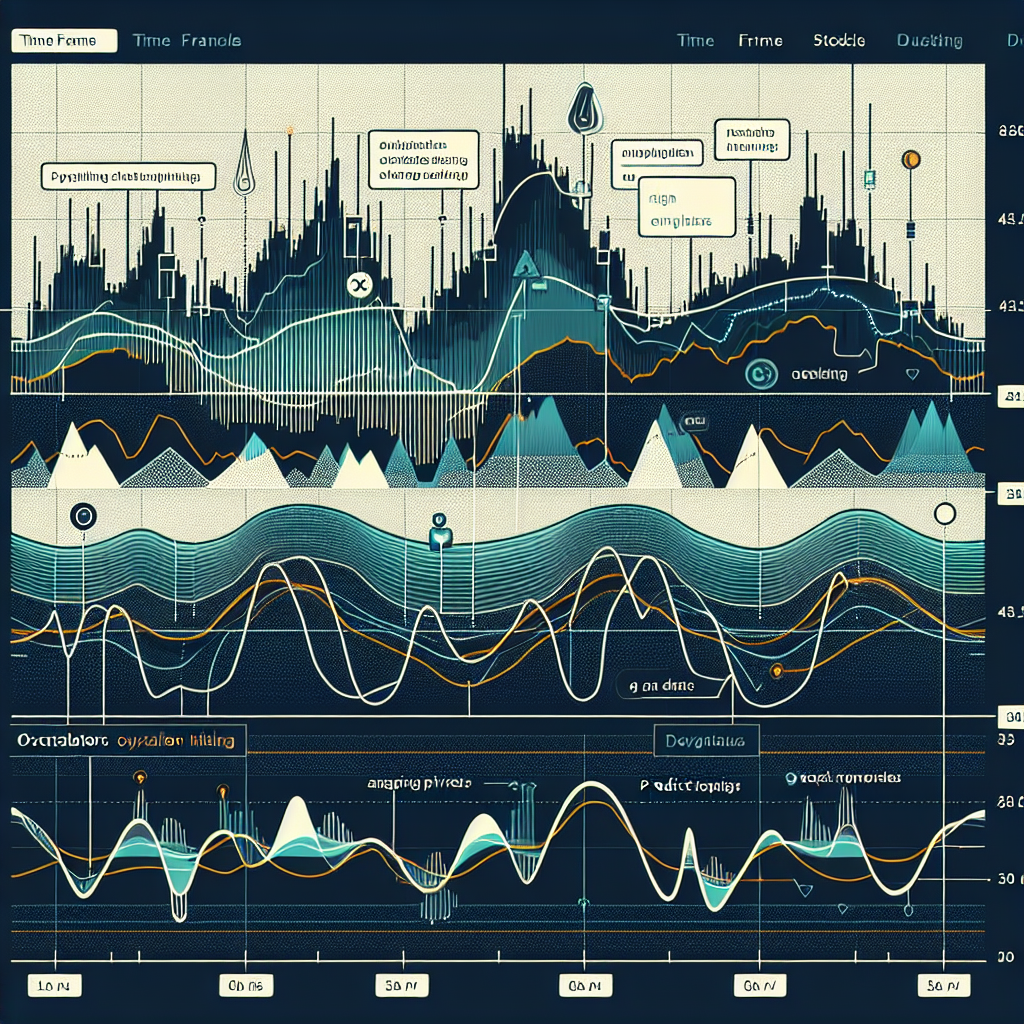

Applying Oscillators in Market Timing

Market timing is a critical aspect of trading and investment. It involves making buy or sell decisions by predicting the market’s future direction. One way to enhance market timing is by applying oscillators. Oscillators are technical analysis tools that generate readings within a set range, typically between zero and 100, to help traders identify periods of overbuying or overselling.

Understanding Oscillators

Oscillators are a type of technical indicator that fluctuates over time within a band. They are most useful in non-trending markets where price fluctuations are more predictable. Oscillators can signal when the market is overbought (a potential sell signal) or oversold (a potential buy signal).

Types of Oscillators

There are several types of oscillators, including:

1. Relative Strength Index (RSI)

2. Stochastic Oscillator

3. Moving Average Convergence Divergence (MACD)

4. Rate of Change (ROC)

Applying Oscillators in Market Timing

The use of oscillators in market timing involves several steps. Here’s how to apply them:

Step 1: Selecting the Right Oscillator

Different oscillators work best under different market conditions. For instance, the RSI and Stochastic Oscillator are more effective in sideways, non-trending markets, while the MACD is useful in trending markets. Therefore, the first step is to identify the current market conditions and select the appropriate oscillator.

Step 2: Understanding the Oscillator Readings

Each oscillator has a different scale, but most oscillate between zero and 100. A reading above 70 typically indicates an overbought market, suggesting it may be time to sell. Conversely, a reading below 30 often signals an oversold market, indicating it might be time to buy.

Step 3: Confirming the Signals

Oscillators can generate false signals, so it’s essential to confirm them with other technical analysis tools or indicators. For instance, you might use trend lines or moving averages to verify an oscillator signal.

Step 4: Implementing the Strategy

Once you’ve confirmed the oscillator signal, you can implement your trading strategy. This might involve buying or selling securities, adjusting your portfolio, or taking other actions based on the signal.

Advantages and Limitations of Oscillators

Advantages

Oscillators provide objective measurements of market conditions, helping traders identify potential buy and sell opportunities. They can also help traders spot divergences, which occur when the price of an asset and an oscillator are moving in opposite directions, signaling potential market reversals.

Limitations

Despite their benefits, oscillators also have limitations. They can produce false signals, particularly in strong trending markets. Additionally, they are lagging indicators, meaning they reflect past market movements and may not accurately predict future trends.

Conclusion

Oscillators are powerful tools for market timing, but they should be used in conjunction with other technical analysis tools and strategies. By understanding how to apply oscillators and interpret their signals, traders can enhance their market timing skills and potentially improve their trading performance.