Introduction to Fibonacci Retracement

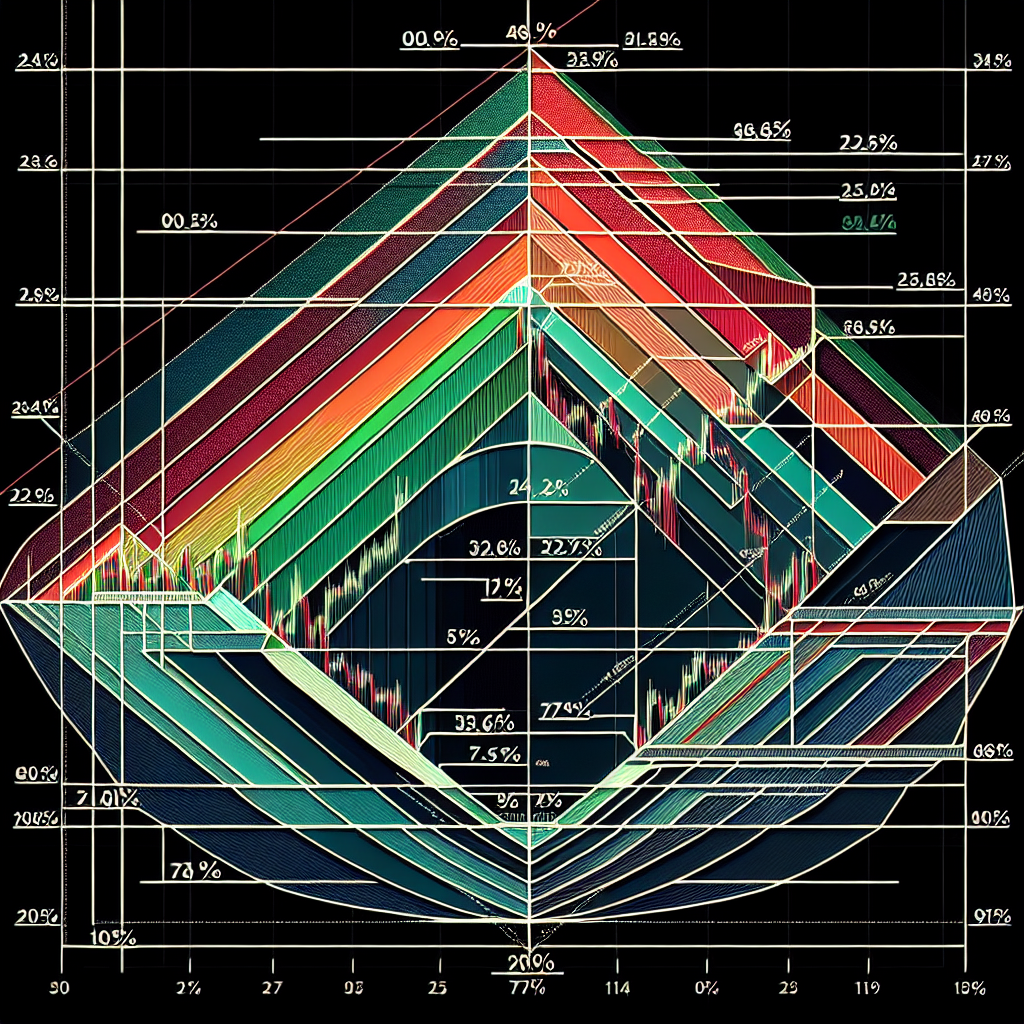

Fibonacci retracement is a popular tool used by traders and analysts to predict future price movements of assets. This tool is based on the Fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones. In the context of trading, Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction. These levels are determined by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios, which are 23.6%, 38.2%, 50%, 61.8%, and sometimes 78.6%.

Applications of Fibonacci Retracement in Trading

Fibonacci retracement is a versatile tool that can be applied in various aspects of trading. Below are some of the applications where Fibonacci retracement proves to be highly effective.

Finding Support and Resistance Levels

One of the primary applications of Fibonacci retracement is identifying potential support and resistance levels. Traders look for significant price movements and apply Fibonacci retracement to forecast where the price might find support or resistance and reverse or at least stall.

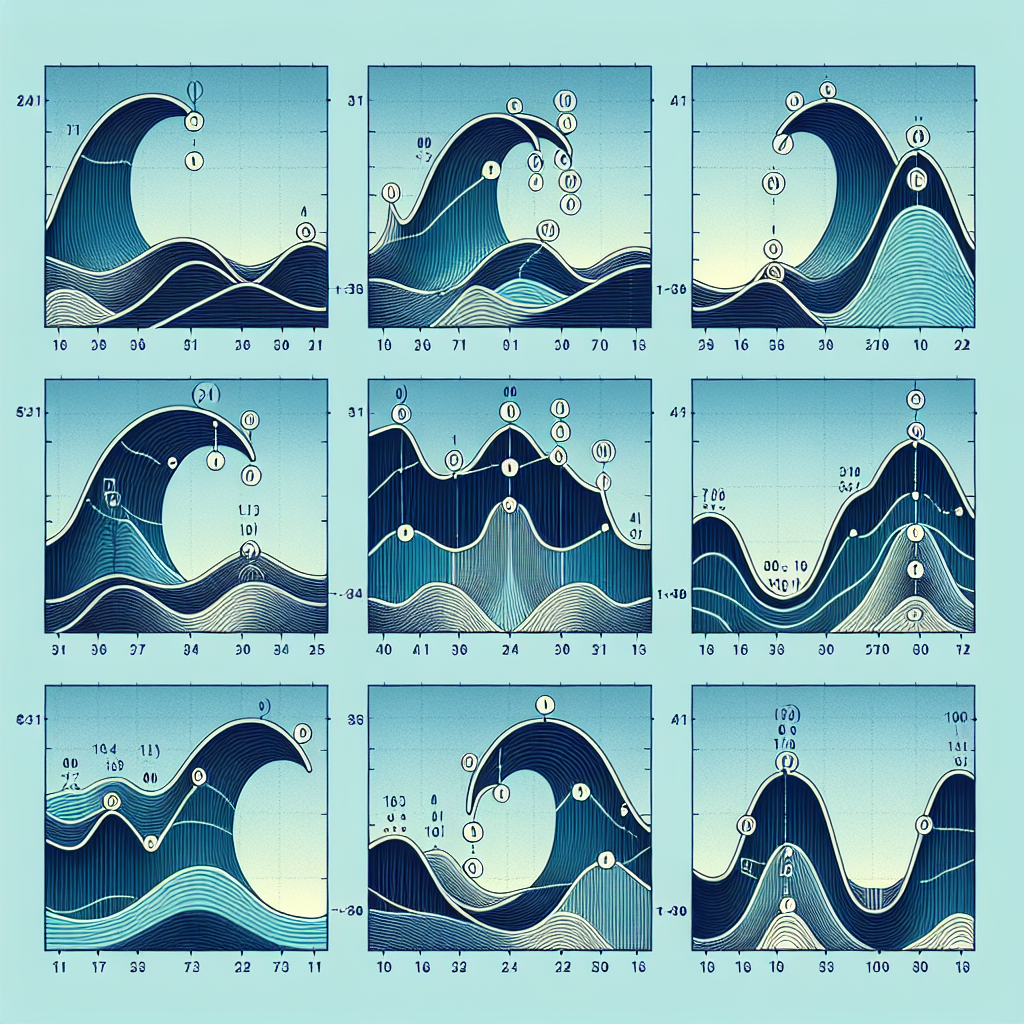

Predicting Reversal Points

Traders often use Fibonacci retracement levels to predict potential reversal points in the market. This is particularly useful in trending markets where the price action is expected to retrace to a certain level before continuing the trend.

Setting Stop-Loss and Take-Profit Orders

Fibonacci levels can guide traders on where to set stop-loss and take-profit orders. For example, if a trader predicts that the price will rebound from a specific Fibonacci level, they might place a take-profit order just before the next resistance level and a stop-loss order below the nearest support level.

Entry and Exit Points

Fibonacci retracement can also be used to determine optimal entry and exit points. By combining the tool with other indicators, traders can increase their chances of entering or exiting trades at the most opportune times.

How to Use Fibonacci Retracement in Trading

Applying Fibonacci retracement in trading involves a few straightforward steps.

Selecting the Swing High and Swing Low

The first step is to identify the most recent swing high and swing low points on the chart. These points are the extremes where the price direction had a significant reversal.

Drawing the Fibonacci Levels

After identifying these points, the next step is to connect them with a Fibonacci retracement tool. Most trading platforms have this tool available. Once applied, it will automatically display the retracement levels between the high and low.

Analyzing the Retracement Levels

Traders should then analyze the retracement levels for potential trading opportunities. These levels are watched closely for signs of reversal, such as candlestick patterns or confirmation from other indicators.

Making Trading Decisions

When a convincing signal occurs at a Fibonacci level, traders may decide to enter or exit trades based on their analysis of the market, the strength of the reversal signal, and their risk management strategy.

Conclusion

Fibonacci retracement is an indispensable tool in the arsenal of many traders, offering great insights into future market movements. However, it’s important to note that no tool or indicator guarantees 100% success in trading. Therefore, traders should use Fibonacci retracement in conjunction with other tools and indicators to confirm their findings and make more informed decisions. With practice and proper application, Fibonacci retracement can substantially enhance trading strategies and increase the chances of profitable trades.