## Using Divergence in Trading Strategies

Divergence in trading refers to the disagreement between price action and technical indicators on the chart, often pointing toward potential reversals, continuations, or slow-down in price trends. Understanding and effectively using divergence can significantly enhance trading strategies, providing traders with insights into market momentum and potential shifts in direction. This article explores the concept of divergence, its types, and how to incorporate it into your trading strategies.

###

Understanding Divergence

Divergence occurs when the price of an asset moves in the opposite direction of a technical indicator, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator. This phenomenon signals that the current trend may be weakening and could reverse or experience a pullback soon.

###

Types of Divergence

Divergence is mainly classified into two types: regular and hidden.

####

Regular Divergence

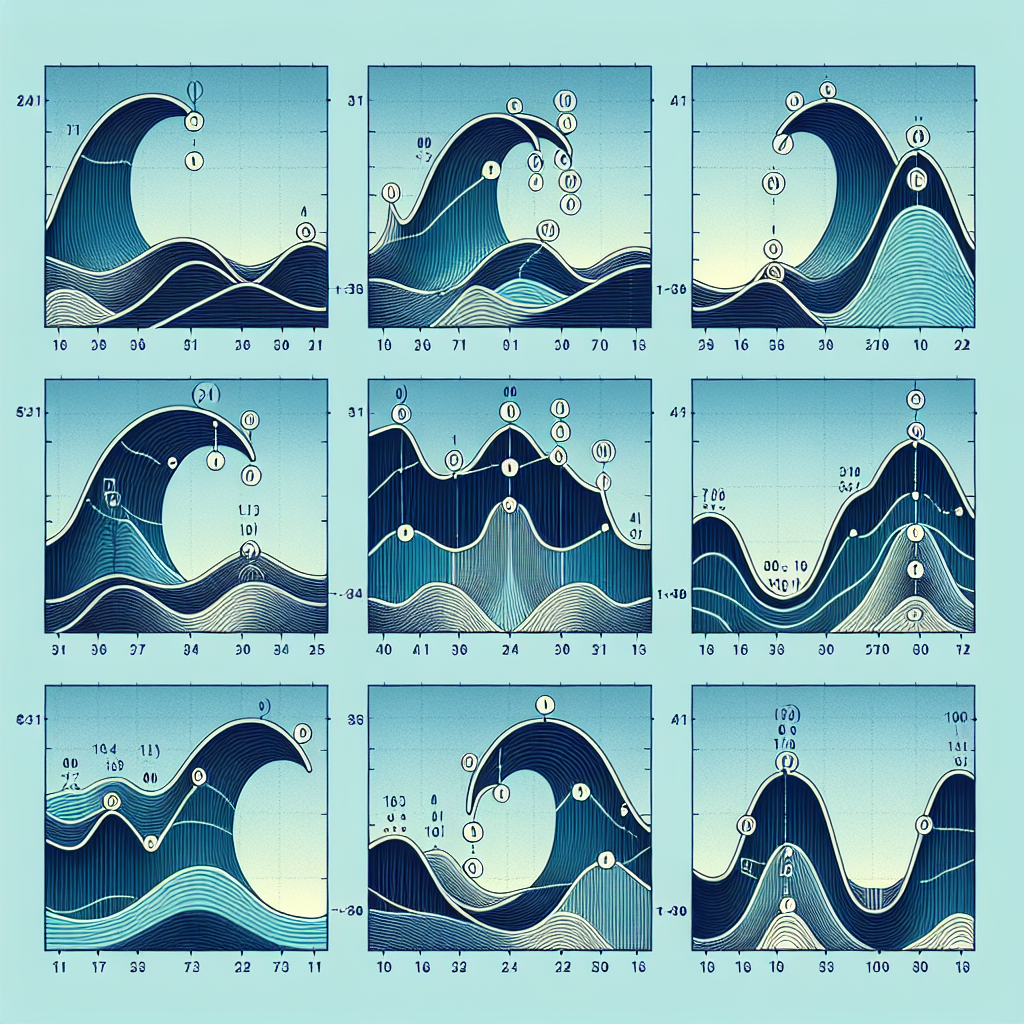

Regular divergence signals a potential reversal in trend. It is further divided into regular bullish and regular bearish divergence.

– **Regular Bullish Divergence:** Occurs when the price records a lower low, but the technical indicator makes a higher low. This implies potential upward momentum, indicating a possible bullish reversal.

– **Regular Bearish Divergence:** Appears when the price achieves a higher high, but the indicator prints a lower high, signifying potential downward momentum and suggesting a bearish reversal.

####

Hidden Divergence

Hidden divergence indicates trend continuation. Like regular divergence, it is divided into bullish and bearish signals.

– **Hidden Bullish Divergence:** Happens when the price makes a higher low, but the indicator shows a lower low. This pattern suggests the continuation of an upward trend.

– **Hidden Bearish Divergence:** Identified when the price forms a lower high, but the indicator indicates a higher high. This pattern implies the continuation of a downtrend.

###

Incorporating Divergence into Trading Strategies

To effectively utilize divergence in trading strategies, traders should follow a few important steps.

####

Step 1: Choose the Right Indicators

The first step is selecting appropriate indicators that best show divergence. Commonly used indicators include the MACD, RSI, and Stochastic Oscillator. Each has its unique characteristics, so choose one that aligns with your trading style and preferences.

####

Step 2: Identify Divergence Patterns

Carefully examine charts to spot divergence patterns between price action and your chosen technical indicator. Look for instances where the price and indicator fail to make higher highs or lower lows in unison.

####

Step 3: Confirm with Other Technical Analysis Tools

Before making a trade based on divergence, confirm the signal with other technical analysis tools and patterns. This could include trend lines, support and resistance levels, or candlestick patterns, adding a layer of assurance to your decision.

####

Step 4: Set Stop-Loss and Take-Profit Points Wisely

To manage risk effectively, set stop-loss orders just beyond recent swing highs or lows and determine take-profit points based on previous support or resistance levels, or using a risk-reward ratio.

####

Step 5: Monitor Trades and Adjust as Necessary

Once a trade is placed based on divergence, it’s critical to monitor it closely and be willing to adjust stop-loss and take-profit levels in response to market movements or if the expected price action does not materialize.

###

Conclusion

Divergence is a powerful tool in the arsenal of trading strategies, offering valuable insights into potential market turns or continuations. By understanding its types and applying it thoughtfully within the broader context of technical analysis, traders can enhance their ability to make informed decisions and manage risk effectively. Remember, no trading strategy guarantees success every time, so it’s crucial to practice sound money management and continuously learn from market observations and experiences.