Introduction to Cyclical Analysis in Trading

Cyclical analysis is a fundamental approach in the trading world that revolves around identifying patterns or cycles in market trends to forecast future price movements. This method is rooted in the belief that history tends to repeat itself and that financial markets move in cyclical patterns. Cyclical analysis can be applied across various time frames, ranging from intraday trading to long-term investments, and it encompasses a wide array of markets including stocks, commodities, and currencies. Understanding the basic principles of cyclical analysis equips traders with a powerful tool to navigate the often volatile and unpredictable markets.

Understanding Market Cycles

Before diving into cyclical analysis, it’s crucial to grasp the concept of market cycles. Essentially, a market cycle refers to the natural and recurring phases of growth and decline in the market or an asset’s price. These cycles are influenced by numerous factors including economic conditions, sentiment, political events, and major global events.

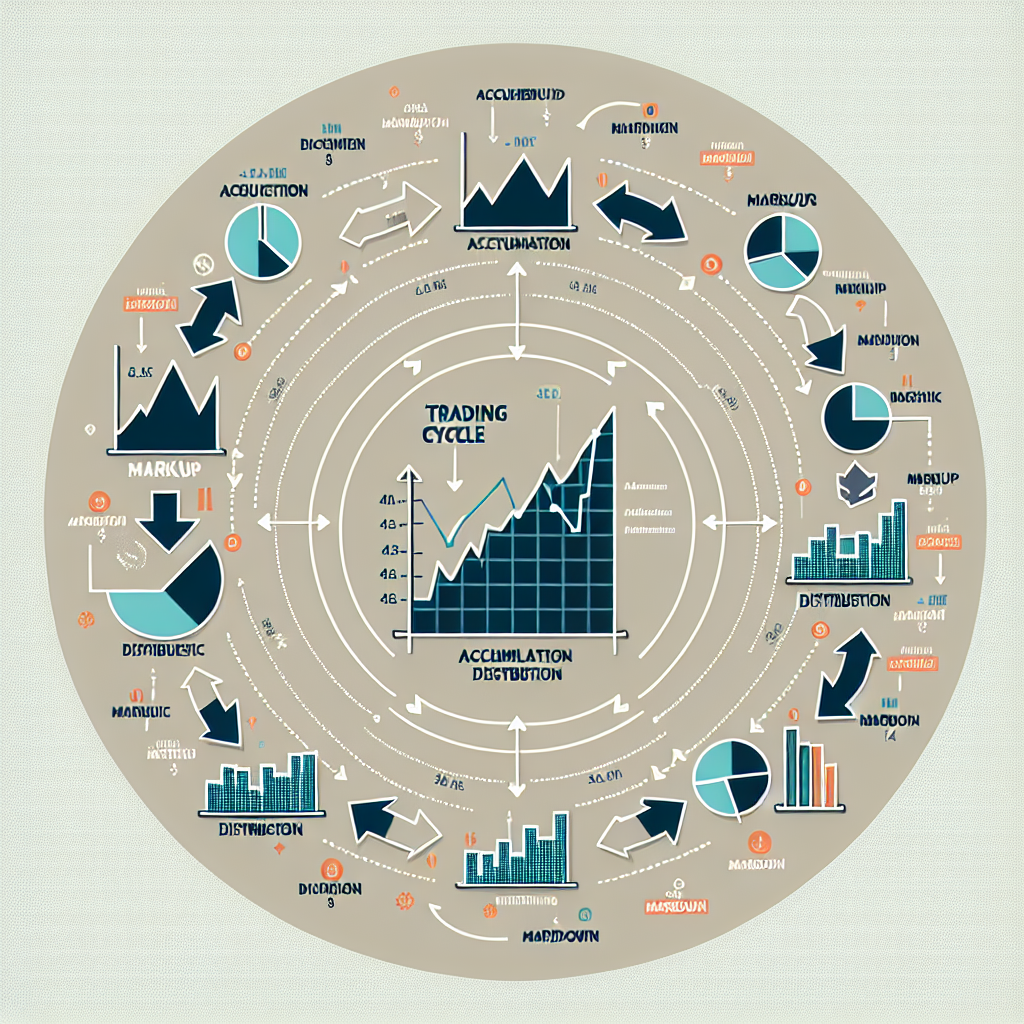

The Four Phases of Market Cycles

Market cycles are typically divided into four main phases: accumulation, uptrend (also known as the markup phase), distribution, and downtrend (or markdown phase).

– Accumulation occurs after a market has bottomed out, when savvy investors start buying or ‘accumulating’ assets when prices are low.

– Uptrend is characterized by increasing prices and higher trading volumes, as more investors begin to notice the upward movement.

– Distribution phase begins when prices have peaked, and early investors start selling their holdings to take profits, leading to increased supply and the start of a downtrend.

– Downtrend marks the phase where prices fall, resulting in decreased investor interest until the cycle starts again with accumulation.

Applying Cyclical Analysis to Trading

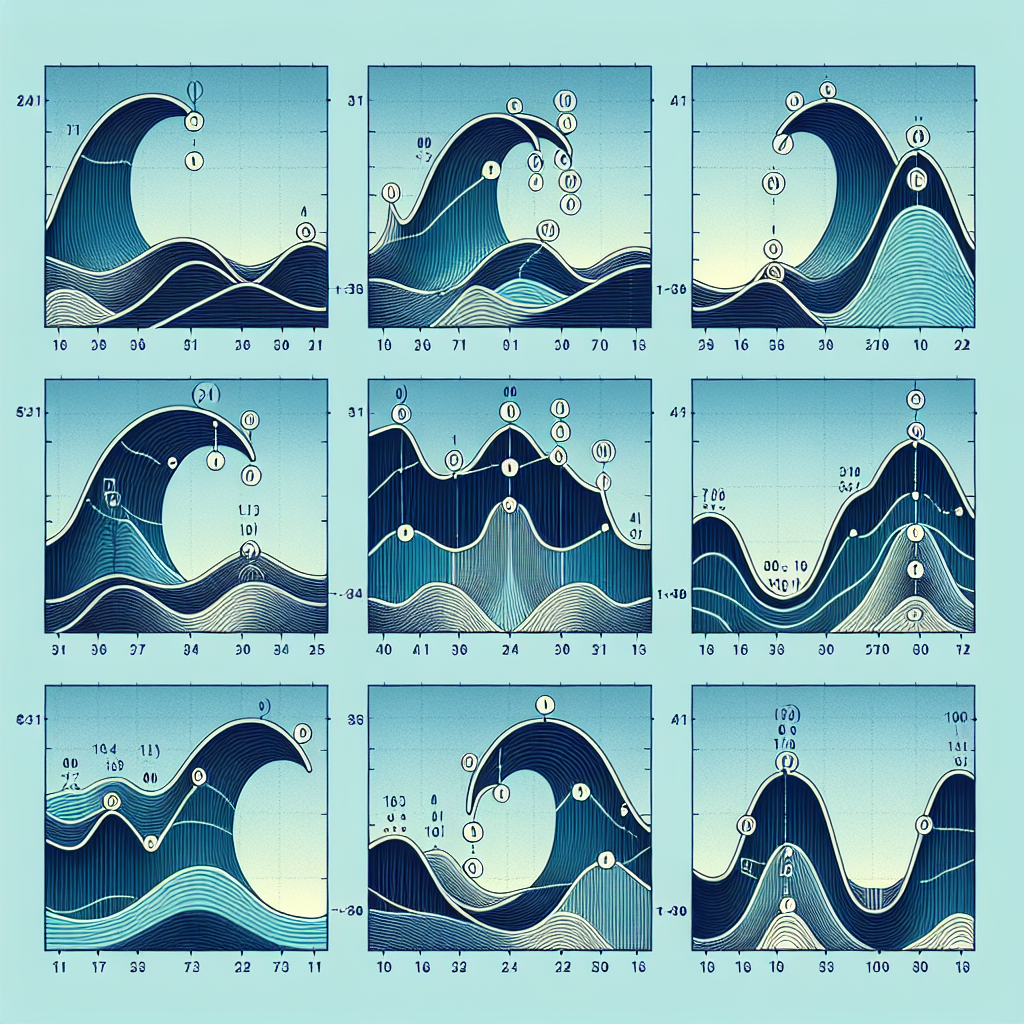

To utilize cyclical analysis effectively, traders need to identify the rhythm of market cycles and align their trading strategies accordingly. This requires a combination of technical analysis, historical data review, and a keen understanding of market sentiment and economic indicators.

Step 1: Identifying Market Cycles

The first step is to identify the current phase of the market cycle. This involves analyzing price charts, using technical indicators like moving averages, and considering economic indicators that might impact the market. Identifying patterns from past cycles can be tremendously helpful in predicting future movements.

Step 2: Strategy Alignment

Once you’ve identified the cycle phase, align your trading strategy to capitalize on expected movements. For example, during the accumulation phase, a trader might adopt a buying strategy, focusing on undervalued assets that are likely to appreciate. During distribution or the beginning of a downtrend, strategies might shift towards selling or short-selling to profit from falling prices.

Step 3: Continuous Monitoring and Adjustment

Cyclical analysis is not a set-and-forget strategy. Continuous monitoring of market indicators, news, and cyclical patterns is essential for adjusting your strategy as the cycle progresses. This dynamic approach helps in managing risks and optimizing potential returns.

Benefits and Limitations of Cyclical Analysis

Cyclical analysis offers traders a framework for understanding and anticipating market movements. It provides a disciplined approach to trading, aiding in better decision-making by focusing on larger, identified patterns rather than short-term noise. However, it’s important to recognize its limitations. Market cycles can be disrupted by unexpected events, and the timing of cycle phases can vary widely. As such, cyclical analysis should be used in conjunction with other analysis forms for a more holistic trading strategy.

Conclusion

Cyclical analysis in trading offers a valuable perspective for forecasting market trends based on the recognition of repetitive patterns and phases. By comprehending the underlying principles of market cycles and aligning strategies accordingly, traders can make more informed decisions, manage risks effectively, and capitalize on the opportunities presented by cyclic movements. Nonetheless, the unpredictable nature of financial markets necessitates a balanced approach, combining cyclical analysis with other analytical tools for optimal trading outcomes.