# Advanced Ichimoku Cloud Strategies

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals. It is a favored instrument among many traders for its ability to consolidate multiple analyses into a single glance. While the basics of the Ichimoku Cloud can be pivotal for traders, mastering advanced strategies can significantly enhance trading decision-making. This article delves into such advanced strategies, aiding traders in leveraging the full suite of insights provided by the Ichimoku Cloud.

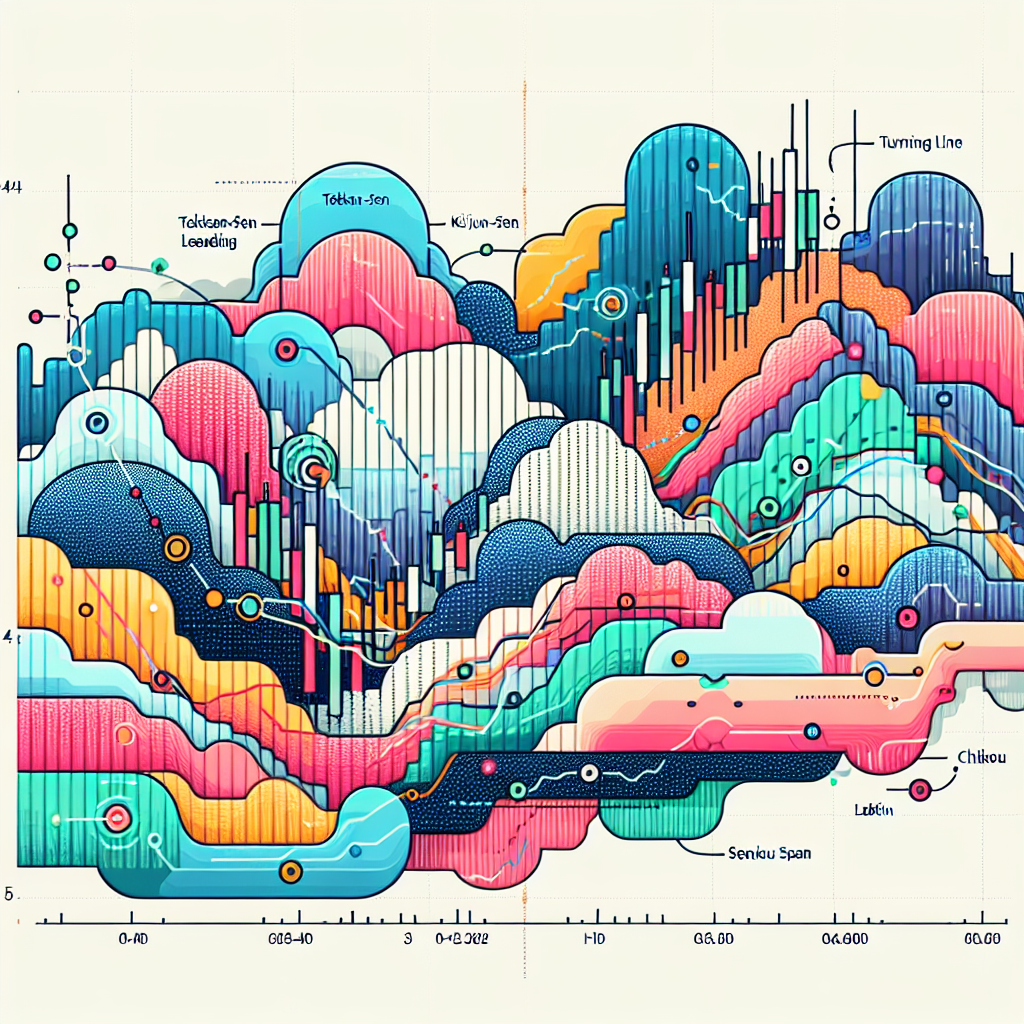

Understanding the Components

Before diving into advanced strategies, it’s crucial to have a grasp of the Ichimoku Cloud’s five primary components: Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span). Each plays a vital role in the indicator’s overall analysis.

Strategy 1: The Kumo Twist

The Kumo, or cloud, is made up of Senkou Span A and Senkou Span B, and it shifts in color when these lines cross. A change in the cloud’s color, known as a “Kumo twist,” can indicate a shift in the market sentiment.

Trading on a Kumo Twist

A bullish Kumo twist occurs when the Senkou Span A crosses above Senkou Span B, changing the cloud’s color from red to green. Conversely, a bearish twist is signaled when Senkou Span A falls below Senkou Span B, turning the cloud from green to red. Traders might consider entering a position in the direction of the twist, acknowledging that this signal alone should be corroborated with other indicators for confirmation.

Strategy 2: Using the Chikou Span

The Chikou Span, or Lagging Span, is plotted 26 periods in the past and can provide unique insights into market momentum.

Confirmation with the Chikou Span

An advanced strategy involves comparing the Chikou Span’s position relative to the price 26 periods ago. If the Chikou Span is above the price, it could indicate bullish momentum, whereas if it’s below, bearish momentum is suggested. Furthermore, traders can look for the Chikou Span to break through prices or the cloud as a signal of potential reversals or trend strength.

Strategy 3: Depth of the Kumo

The thickness of the Kumo can serve as an indicator of market volatility and support or resistance strength.

Interpreting Kumo Thickness

A thicker Kumo suggests strong support or resistance, meaning that a price breakout through the cloud could signify a powerful move. Conversely, a thin Kumo indicates weaker support or resistance, potentially making it easier for the price to pass through. Traders might use the thickness of the Kumo, in combination with other signals, to gauge the strength of a trend.

Strategy 4: Kijun-Sen Cross

The Kijun-sen, or Base Line, serves as a component in another advanced strategy known as the “Kijun-Sen Cross.”

The Significance of the Kijun-Sen Cross

An upward cross of the Tenkan-sen over the Kijun-sen can be seen as a bullish signal, especially if occurring above the cloud. Conversely, a downward cross under the Kijun-sen indicates bearish momentum, particularly if it happens below the cloud. This strategy emphasizes the importance of context, as the position of the cross in relation to the cloud matters significantly for interpreting the signal’s strength.

Combining Strategies for Enhanced Analysis

While each of these strategies can provide valuable insights, their power is fully unleashed when combined. Traders should consider integrating these techniques with broader market analysis, including fundamentals, to enhance their decision-making process.

Final Thoughts

Advanced Ichimoku Cloud strategies offer a deeper dive into market psychology and dynamics. However, as with any trading strategy, there is no one-size-fits-all approach. It is essential for traders to practice and refine these strategies within their broader trading plan and risk management framework. Remember, the ultimate goal is to develop a well-rounded trading methodology that aligns with individual goals and market perspectives.