Risk Management Using Technical Analysis

Technical analysis is a trading discipline used to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. It is one of the most popular methods used by traders to manage their risks. This article will delve into how technical analysis can be utilized for effective risk management.

Understanding Technical Analysis

Technical analysis is a method that employs chart patterns and indicators to predict future price movements. It is based on three fundamental ideas: the market discounts everything, price moves in trends, and history tends to repeat itself. Traders use this method to make informed decisions about when to enter and exit trades, thereby managing their risk.

Key Components of Technical Analysis

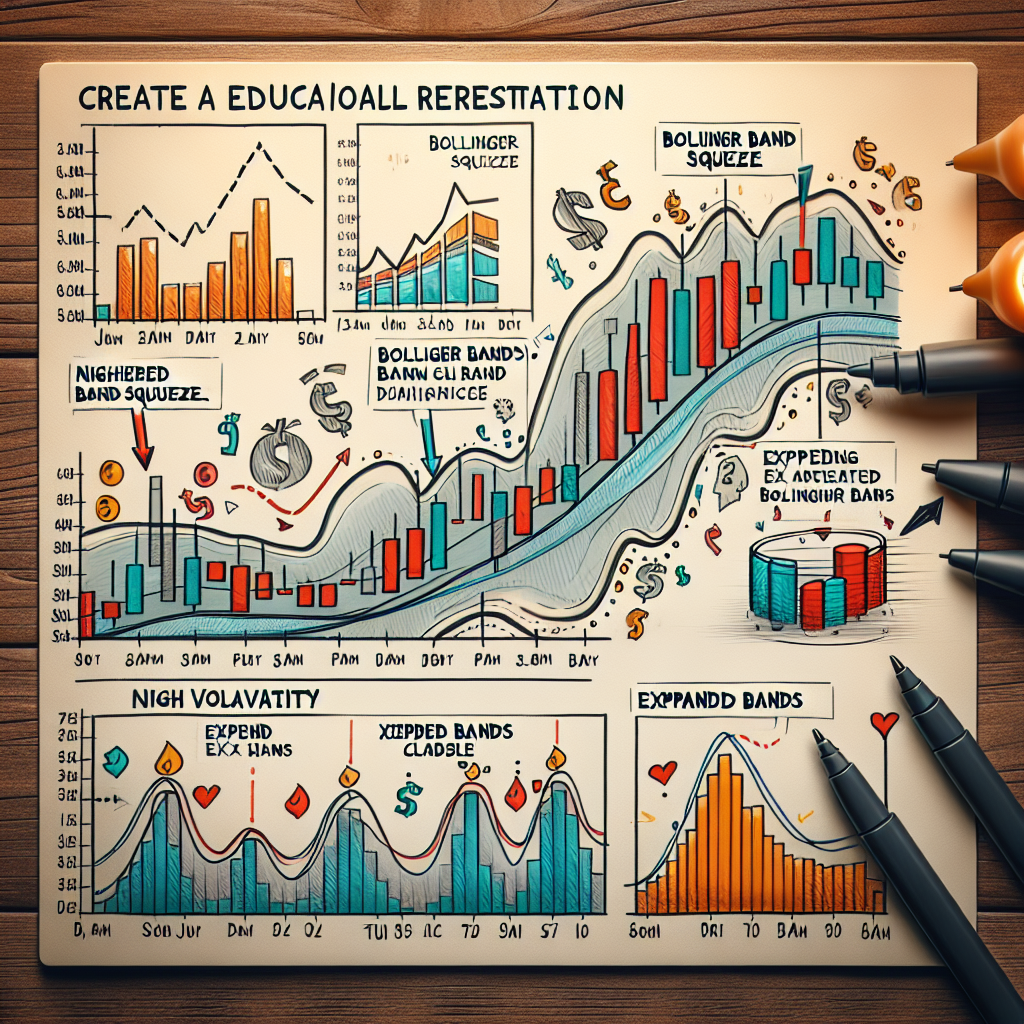

Technical analysis involves a variety of charts and mathematical concepts. These include but are not limited to:

- Price charts: These are the foundation of technical analysis. They display the price history of an asset over a specific period.

- Trends: These are directional movements of prices. Trends can be upward (bullish), downward (bearish), or sideways.

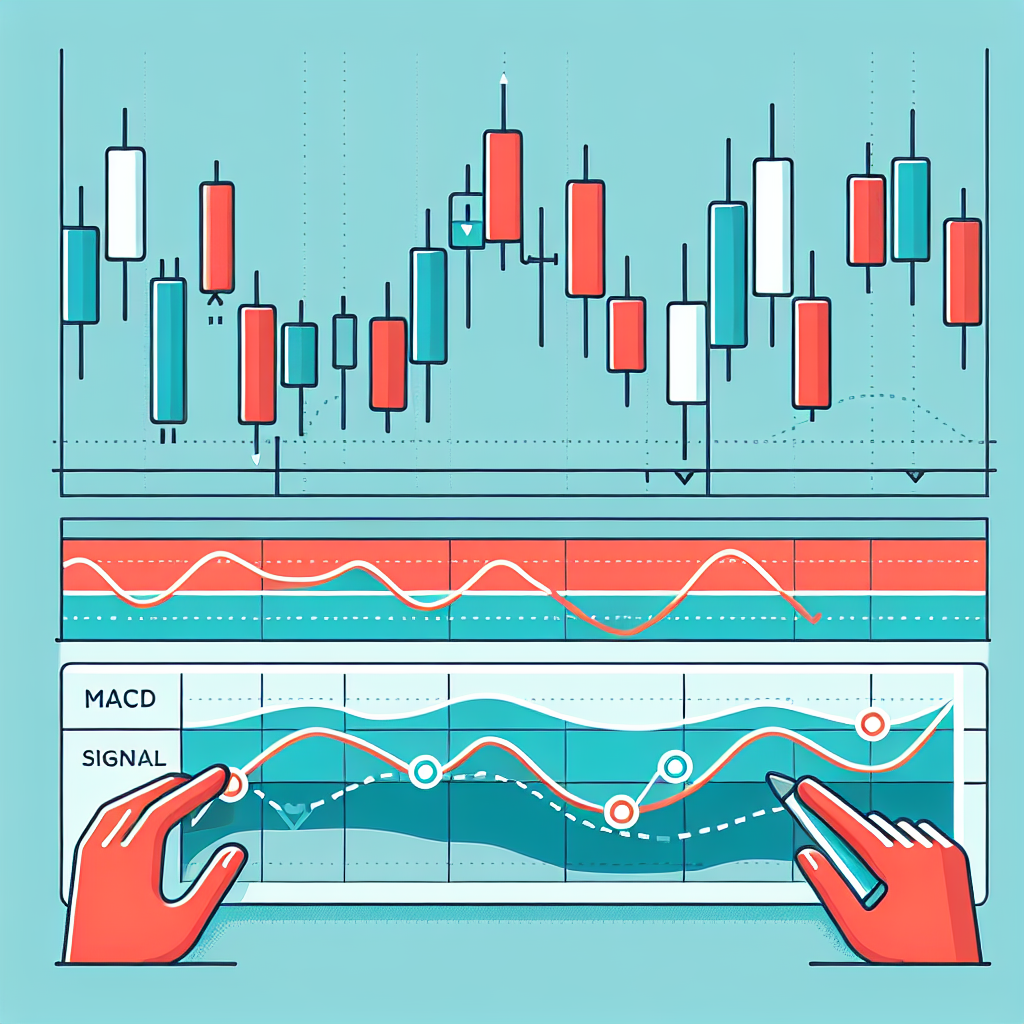

- Indicators: These are mathematical calculations based on price and volume. They help to predict future price movements.

- Patterns: These are specific shapes formed on price charts. They provide an indication of where the prices might go next.

Using Technical Analysis for Risk Management

Effective risk management is crucial for successful trading. Technical analysis provides several tools that can help traders manage their risks effectively.

Setting Stop-Loss Orders

One of the primary ways to manage risk using technical analysis is by setting stop-loss orders. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. It is designed to limit an investor’s loss on a security position. By studying technical analysis charts, traders can identify potential price levels to set their stop-loss orders.

Identifying Trend Reversals

Technical analysis can help traders identify trend reversals, which can be critical in risk management. By recognizing a reversal in a timely manner, traders can exit a losing trade before it results in a significant loss.

Determining Position Size

Another way to use technical analysis for risk management is by determining the position size. By understanding the volatility and potential price range of an asset, traders can decide how much of that asset to buy or sell. This can help to limit potential losses.

Conclusion

While technical analysis cannot guarantee success, it is a powerful tool for managing risk. By understanding and applying its principles, traders can make more informed decisions and limit their potential losses. Like any other tool, it’s effectiveness relies heavily on the user’s understanding and application. Therefore, continuous learning and practice are essential for anyone looking to use technical analysis for risk management.