Introduction to Dow Theory

Dow Theory is a fundamental concept in the field of market analysis and forecasting, forming the cornerstone of technical analysis. Developed by Charles H. Dow, co-founder of Dow Jones & Company, this theory presents a methodical way of understanding market movements. It is not merely a tool for predicting stock prices but a comprehensive philosophy emphasizing the market’s behaviour. By dissecting the market into three distinct movements and analyzing the interplay between industrial and transportation sectors, Dow Theory offers investors insight into the overall health of the economy and potential market trends.

Foundational Principles of Dow Theory

Dow Theory is built upon six basic principles that guide analysts in interpreting market data and making predictions. Understanding these principles is crucial for anyone looking to apply Dow Theory in market forecasting.

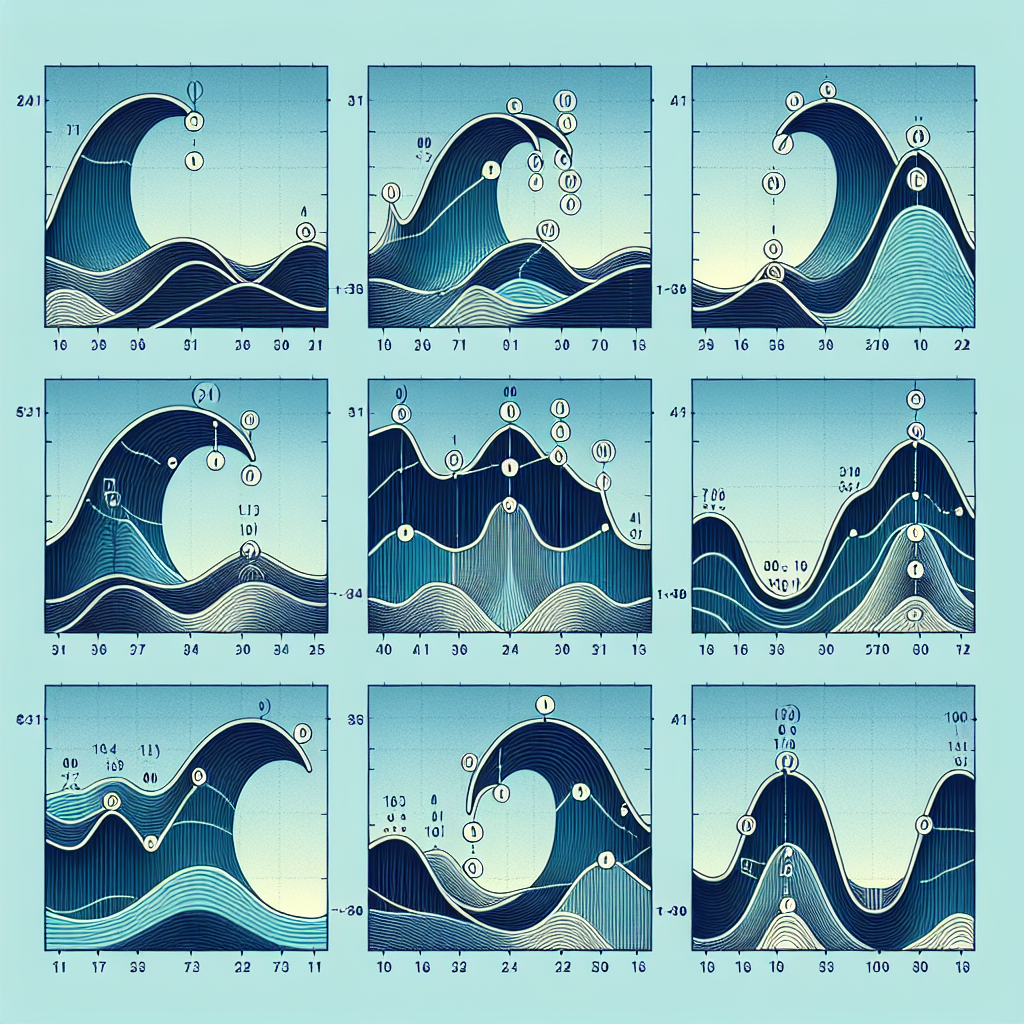

The Market has Three Movements

The theory breaks down market movements into three types: the “Primary” trend, which can last a year or more and reflects the broad market direction; the “Secondary” trend, which can last from three weeks to three months and serves as a correction or counter-move to the primary trend; and the “Minor” trend, which is short-term noise that lasts less than three weeks.

Market Trends Have Three Phases

Each major market trend – bullish or bearish – unfolds in three phases. According to Dow, a bullish market consists of the accumulation phase, the public participation phase, and the distribution phase. Conversely, a bearish market comprises a distribution phase, a public participation phase, and a panic or despair phase.

The Market Discounts All News

One of the theory’s core assertions is that all current news, events, and market factors are already reflected in stock prices. Therefore, the analysis of price movements, rather than external factors, is deemed more reliable for predicting future market behaviour.

Indices Must Confirm Each Other

Dow originally applied his theory to the Dow Jones Industrial and Rail (now Transportation) averages. He posited that for a market trend to be established, these indices must confirm each other. For instance, a new high in the Industrial Average without a corresponding new high in the Transportation Average would signal weakness in the market bull trend.

Volume Must Confirm the Trend

Volume plays a crucial role in confirming market trends according to Dow Theory. An upward trend accompanied by increasing volume is seen as stronger and more likely to persist than a trend with dwindling volume.

Trends Persist Until Definitive Signals Prove Otherwise

A fundamental tenet of Dow Theory is that trends remain in effect until clear signals demonstrate they have ended. This principle underscores the importance of not prematurely predicting reversals without significant evidence.

Applying Dow Theory in Market Forecasting

Implementing Dow Theory in market analysis and forecasting involves rigorous observation of market indices, a keen eye for identifying phases and trends, and a disciplined approach to interpretation. Investors and analysts use the theory to gauge market sentiment, identify potential entry and exit points, and ultimately, make informed investment decisions. While Dow Theory provides a robust framework for understanding market dynamics, it’s paramount to consider it as part of a comprehensive analysis that includes other factors and indicators to make well-rounded investment choices.

Conclusion

Dow Theory has stood the test of time, offering valuable insights into market trends and investor behaviour for over a century. Although the market landscape has evolved with technology and globalization, the basic principles of Dow Theory remain relevant, guiding investors through the complexities of market forecasting. By respecting the market’s historical tendencies and combining Dow’s insights with modern analysis tools, investors can navigate the financial markets with greater confidence and precision.