Asset Allocation Strategies

Introduction

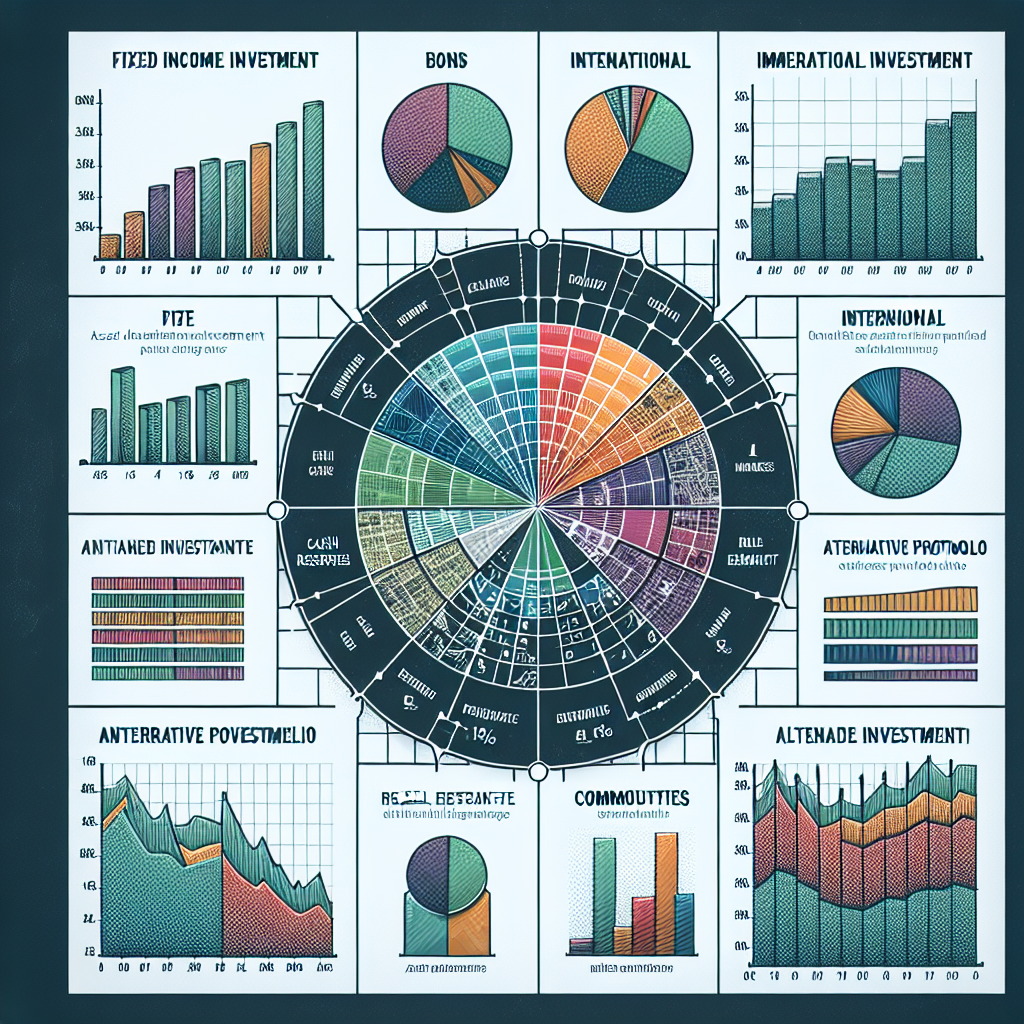

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance, and investment horizon. It involves diversifying investments across various asset classes such as equities, fixed-income, and cash equivalents. The process of determining which mix of assets to hold in a portfolio is a personal one and depends on the time frame of investment, risk tolerance, and investment goals. In this article, we delve into various asset allocation strategies that can help you optimize your investment portfolio.

Strategic Asset Allocation

This is a portfolio strategy that involves setting target allocations for various asset classes and rebalancing periodically. The portfolio is designed with the aim of achieving optimal balance between expected risk and returns for a long-term investment horizon. The strategy assumes that the capital markets will perform efficiently in the long run, and aims to construct a portfolio that is aligned with the investor’s risk and return expectations.

Steps to Implement Strategic Asset Allocation

- Identify your investment goals and risk tolerance.

- Determine the appropriate asset allocation for your investment goals.

- Select specific investments within each asset class.

- Monitor the portfolio and rebalance as needed.

Tactical Asset Allocation

Tactical asset allocation is a more active investment strategy that tries to position a portfolio into those assets, sectors, or individual stocks that show the most potential for perceived gains. Unlike strategic asset allocation, tactical allocation allows investors to make short-term deviations from their normal asset allocation to capitalize on unusual or exceptional investment opportunities. This strategy requires a somewhat active approach, as it involves frequent adjustments to the portfolio.

Steps to Implement Tactical Asset Allocation

- Begin with a strategic asset allocation.

- Identify sectors or assets that are expected to perform well in the short term.

- Temporarily increase investment in those sectors or assets.

- Return to the original strategic asset allocation when the short-term opportunity has passed.

Constant-Weighting Asset Allocation

Constant-weighting asset allocation is a type of investment strategy that involves rebalancing the portfolio periodically. The goal is to maintain the original portfolio asset allocation. This strategy requires the portfolio to be rebalanced back to the original allocations when they deviate significantly due to differing returns from various assets.

Steps to Implement Constant-Weighting Asset Allocation

- Establish a desired allocation among various assets.

- Monitor the portfolio periodically.

- Rebalance the portfolio back to the desired allocation whenever any given asset class moves more than a predetermined percentage from its original allocation.

Dynamic Asset Allocation

Dynamic asset allocation is an investment strategy that involves the periodic adjustment of a portfolio’s asset allocation, based on the investor’s outlook of the capital market and the economy. This strategy is more complex and requires a deep understanding of the financial markets and economic indicators.

Steps to Implement Dynamic Asset Allocation

- Formulate a market outlook or prediction.

- Adjust the portfolio in accordance with this prediction.

- Monitor the market and adjust the portfolio as needed.

Conclusion

Asset allocation strategies are crucial in managing investment risk and can help you reach your investment goals. The choice of strategy depends on individual investment objectives, risk tolerance, and investment horizon. It’s important to review your investment plan periodically and adjust your asset allocation strategy as needed.