Long-term Investing Strategies for Wealth Building

Investing is a proven method of building wealth over time. However, not all investment strategies yield the same results. Long-term investing strategies, in particular, have been shown to generate substantial wealth when executed correctly. This article will delve into several effective long-term investing strategies that can help you build your wealth over time.

1. Diversification

Understanding Diversification

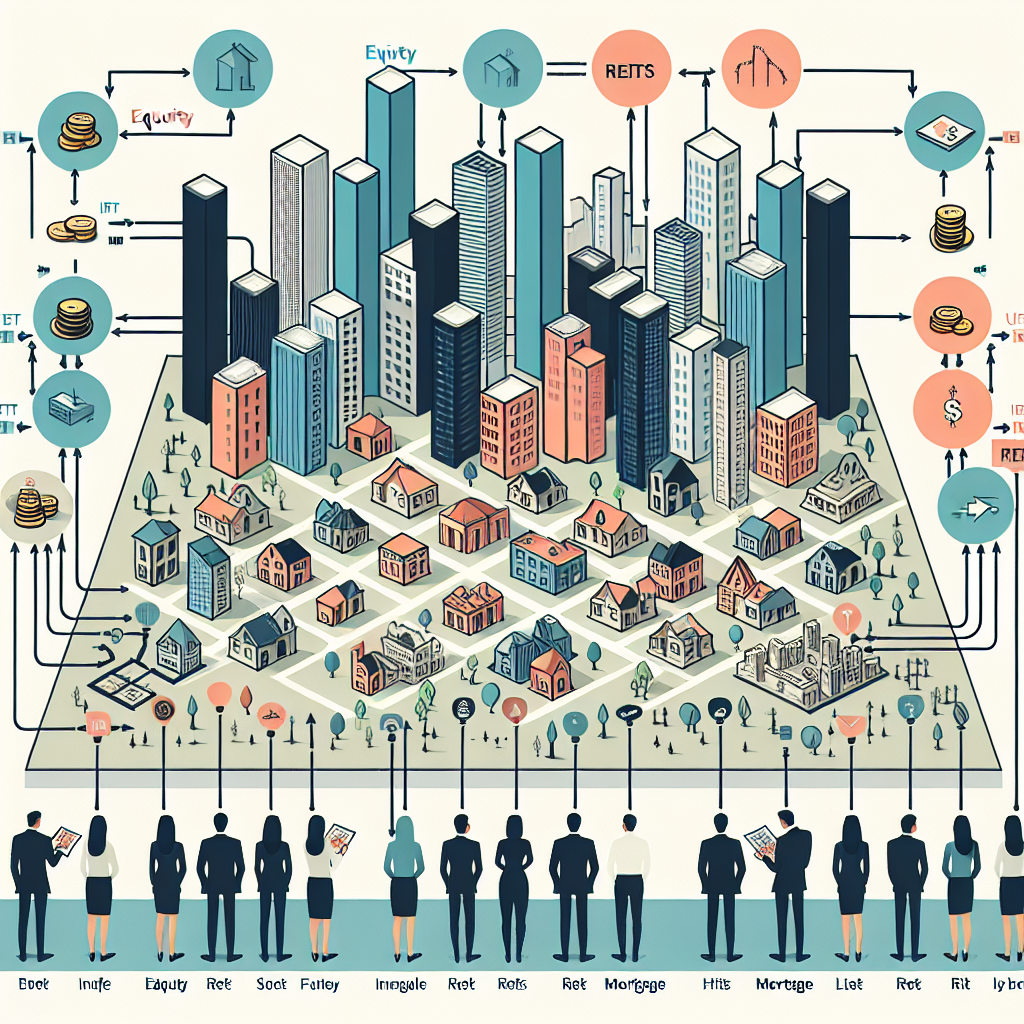

Diversification is a risk management strategy that involves spreading investments across various financial instruments, industries, and other categories to reduce exposure to any single asset or risk. The theory behind this strategy is that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Implementing Diversification

To implement a diversification strategy, you should invest in a mix of asset classes such as stocks, bonds, real estate, and commodities. You should also diversify within each asset class. For example, if you’re investing in stocks, don’t just buy stocks from one company or sector. Spread your investments across different industries and geographic regions.

2. Dollar-cost Averaging

Understanding Dollar-cost Averaging

Dollar-cost averaging is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. The investor purchases more shares when prices are low and fewer shares when prices are high, which can potentially lower the total average cost per share of the investment.

Implementing Dollar-cost Averaging

To implement dollar-cost averaging, decide on the total amount you want to invest in a particular asset and the timeframe over which you want to invest this amount. Then, divide your total investment by the number of periods you chose. This is the amount you will invest per period. For example, if you want to invest $12,000 over a year, you could invest $1,000 each month.

3. Buy and Hold

Understanding Buy and Hold

Buy and hold is a passive investment strategy in which an investor buys stocks (or other types of securities) and holds them for a long period regardless of fluctuations in the market. The premise is that in the long run, financial markets give a good rate of return despite periods of volatility or decline.

Implementing Buy and Hold

Implementing a buy and hold strategy involves thorough research to choose potentially profitable stocks and then holding onto those stocks for a prolonged period. It’s also important to regularly review your portfolio and adjust as needed, but major changes are generally infrequent.

4. Investing in Dividend Stocks

Understanding Dividend Stocks

Dividend stocks are shares in companies that distribute some of their earnings to shareholders in the form of dividends. Dividend investing can be a great way to generate a steady income while waiting for your stock to grow in value.

Implementing Dividend Stocks

To implement a dividend investing strategy, look for companies that have a history of paying high dividends. Companies in sectors such as utilities, consumer staples, and real estate investment trusts (REITs) are often good bets.

Conclusion

Building wealth through long-term investing is a journey that requires patience, discipline, and the right strategies. Diversification, dollar-cost averaging, buy and hold, and investing in dividend stocks are all proven strategies that can help you achieve your financial goals. Remember, every investor’s situation is unique and it’s important to consider your personal financial goals and risk tolerance before implementing any investment strategy.