Understanding Real Estate Investment Trusts (REITs)

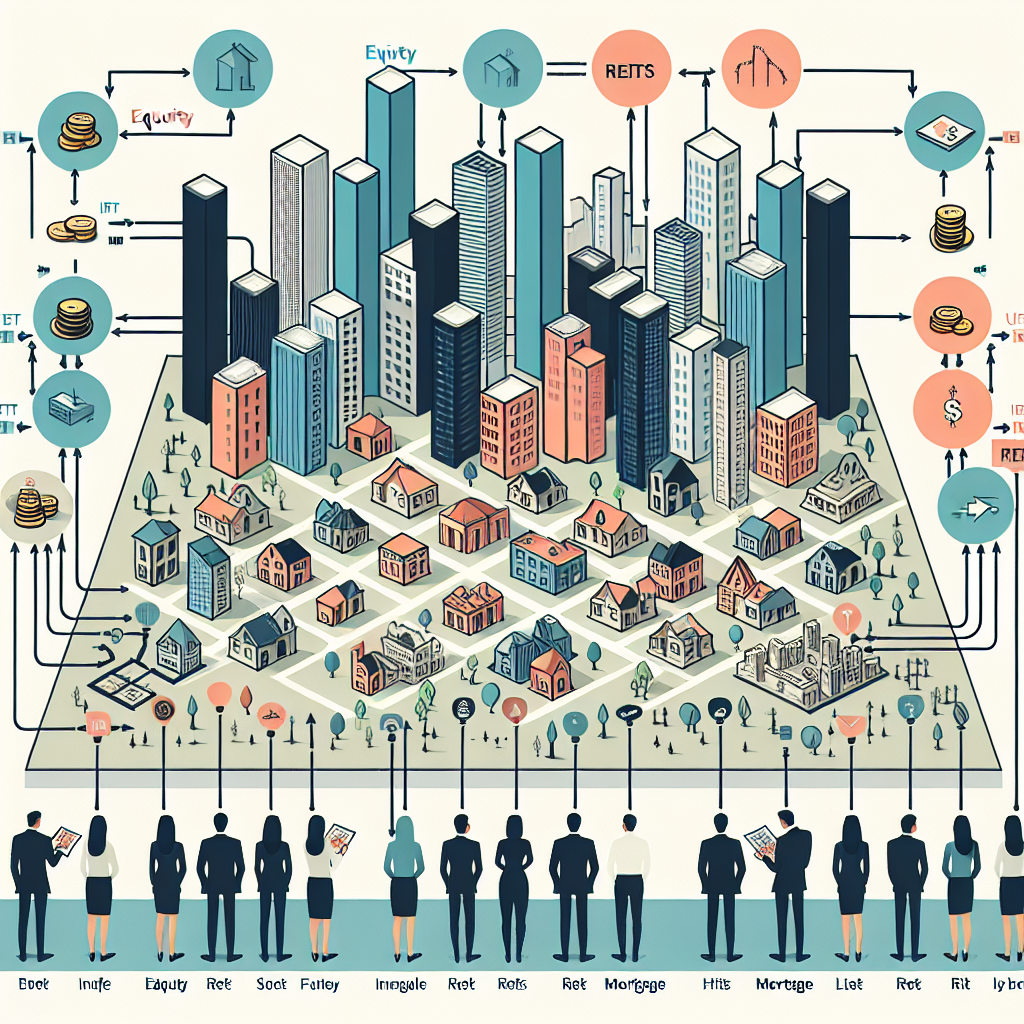

Real estate investment trusts (REITs) have become an increasingly popular option for investors seeking to diversify their portfolios. This article aims to explain the concept of REITs, their benefits, types, and potential risks associated with investing in them.

What are Real Estate Investment Trusts (REITs)?

REITs are companies that own, operate, or finance income-generating real estate. Modeled after mutual funds, REITs provide all investors the chance to own valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

How Do REITs Work?

REITs allow individuals to invest in portfolios of large-scale properties the same way they invest in other industries – through the purchase of stock. When you purchase a share of a REIT, you are essentially buying a physical asset with an inherent value. REITs typically pay out a high percentage of their taxable income as dividends to shareholders. In turn, shareholders pay the income taxes on those dividends.

Types of REITs

There are several types of REITs, and understanding them can help you determine which ones best fit your investment goals.

Equity REITs

Equity REITs are the most common type of REIT. They own and manage income-producing real estate. Rents collected from tenants generate their revenue.

Mortgage REITs

Mortgage REITs lend money to real estate owners and operators either directly through mortgages and loans or indirectly through the acquisition of mortgage-backed securities. Their revenue is generated primarily by the interest earned on the mortgage loans.

Hybrid REITs

Hybrid REITs are a combination of equity and mortgage REITs. They both own properties and hold mortgages.

Benefits of Investing in REITs

Dividend Yield

REITs are required by law to distribute at least 90% of their taxable income annually to shareholders as dividends, making them a favorite among income-seeking investors.

Liquidity

Unlike physical real estate investments, which can take a considerable amount of time to buy or sell, REIT shares can be bought or sold on the stock exchange at any time, providing investors with liquidity.

Diversification

REITs can help to diversify a portfolio because real estate often reacts differently to market conditions compared to stocks and bonds.

Risks of Investing in REITs

As with any investment, there are risks associated with REITs.

Market Risk

The value of a REIT can decline due to general market conditions, regardless of the performance of the specific properties owned by the REIT.

Interest Rate Risk

Like all stocks, the value of REITs can be negatively affected by rising interest rates.

Property Market Risk

Changes in the value of the properties owned by a REIT can affect the value of the REIT itself. If property values decline, so too can the value of the REIT shares.

In conclusion, REITs can be an effective way to invest in real estate without the need to directly own properties. However, as with any investment, it’s essential to understand the potential risks and rewards before investing.