Comparison of Trading Account Features

Introduction

Trading accounts are essential tools for individuals interested in buying and selling securities. They are opened with a brokerage firm which serves as a middleman, facilitating the buying and selling process. With the advent of technology, several brokerage firms now offer online trading accounts that come with a host of features. This article will compare the features of various trading accounts to help you make an informed decision.

Types of Trading Accounts

Before we delve into the features, it is important to understand the different types of trading accounts available. The most common types include:

1. Cash Accounts

This is the most basic type of trading account. Investors can only trade with the capital available in the account.

2. Margin Accounts

These accounts allow investors to borrow money from the broker to buy securities. The securities in the account serve as collateral for the loan.

3. Retirement Accounts

These are specialized accounts designed to help individuals save for retirement. They come with tax advantages but also have restrictions on withdrawals.

Feature Comparison of Trading Accounts

1. Commissions and Fees

Most online brokers charge a commission for each trade. However, there are also brokers that offer commission-free trades. In addition to trade commissions, some brokers may also charge account maintenance fees, inactivity fees, or other miscellaneous fees. It’s important to review all the fees associated with a trading account before opening one.

2. Account Minimums

Some trading accounts require a minimum deposit to get started. This can range from a few dollars to thousands of dollars. On the other hand, there are also brokers that do not have a minimum deposit requirement.

3. Trading Platforms

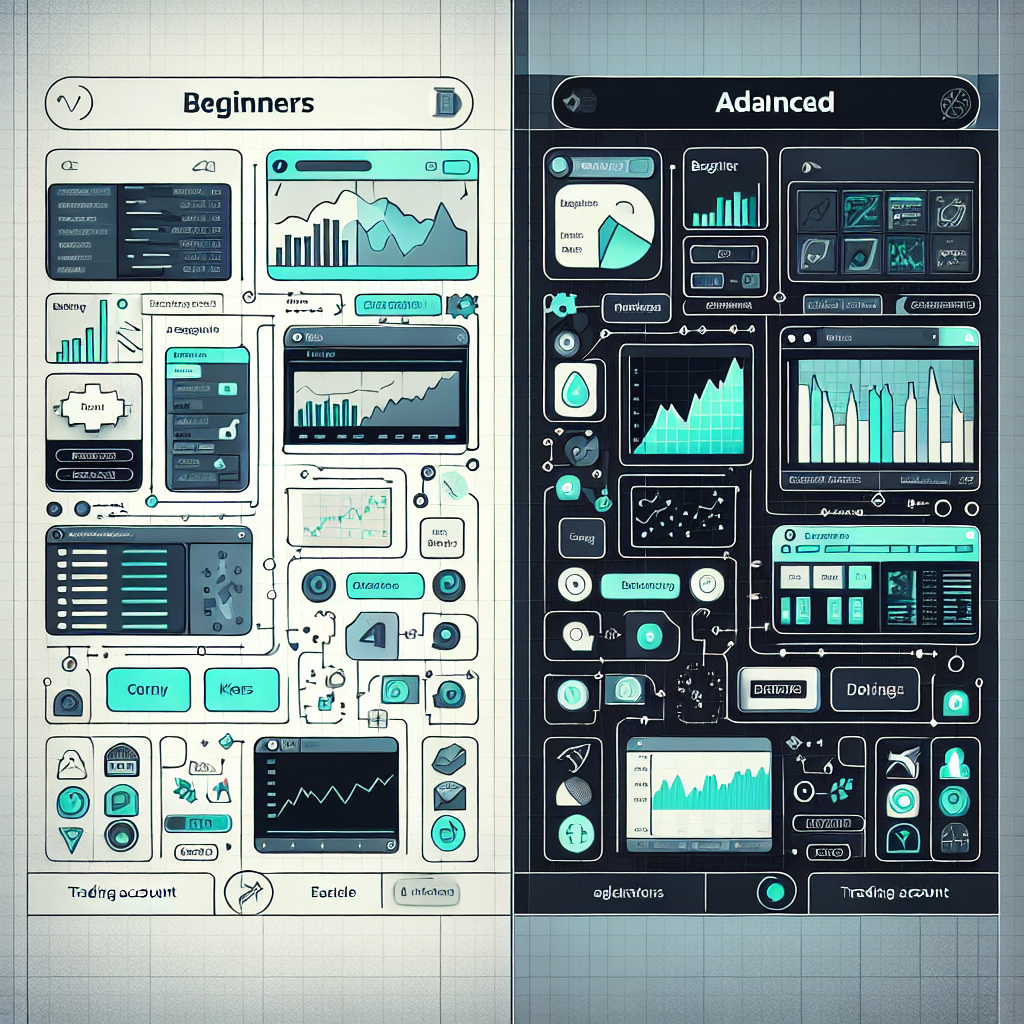

The trading platform is another important feature to consider. A good trading platform should be user-friendly and offer a wide range of tools to help investors analyze the market. Some brokers offer a basic platform for casual investors and a more advanced platform for active traders.

4. Research and Tools

Some brokers offer a wealth of research resources and trading tools. These can include real-time quotes, news feeds, technical analysis tools, and more. These resources can be very helpful for making informed trading decisions.

5. Customer Service

Good customer service is crucial, especially for new traders. The best brokers offer multiple channels of customer support, including phone, email, and live chat. Some brokers also offer 24/7 customer support.

Conclusion

In conclusion, there are many factors to consider when comparing trading accounts. The best trading account for you will depend on your individual needs and trading style. It’s important to take the time to research and compare different brokers before making a decision.