Mastering Market Timing: The Role of Oscillators in Trading

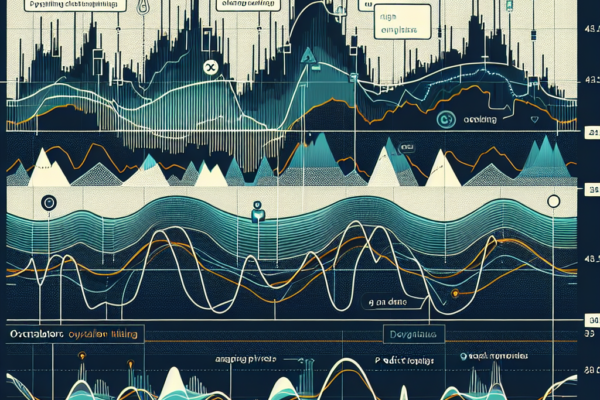

Applying Oscillators in Market Timing Market timing is a critical aspect of trading and investment. It involves making buy or sell decisions by predicting the market’s future direction. One way to enhance market timing is by applying oscillators. Oscillators are technical analysis tools that generate readings within a set range, typically between zero and 100,…