Mastering RSI for Market Momentum Analysis

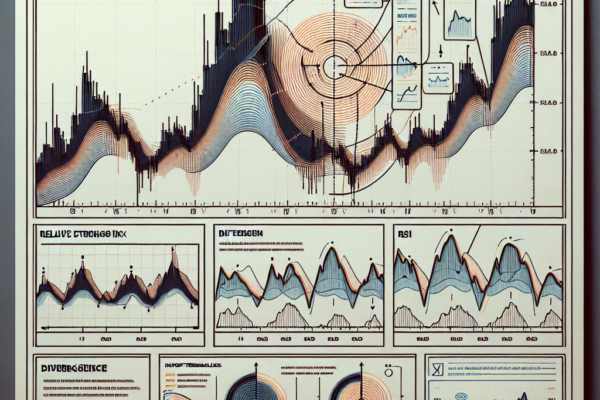

Introduction to the Relative Strength Index (RSI) The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder in 1978, RSI oscillates between zero and 100. Traditionally, the RSI is considered overbought when above 70 and oversold when below 30. This indicator can…