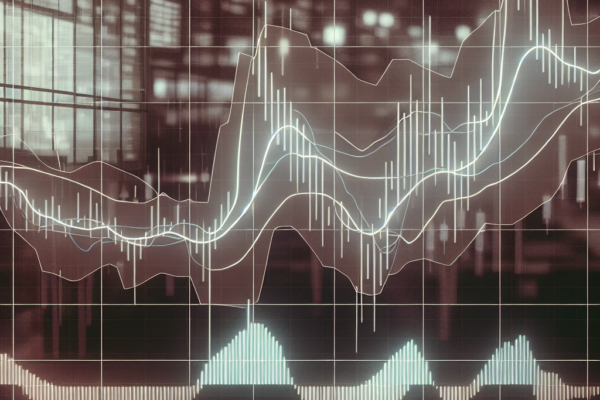

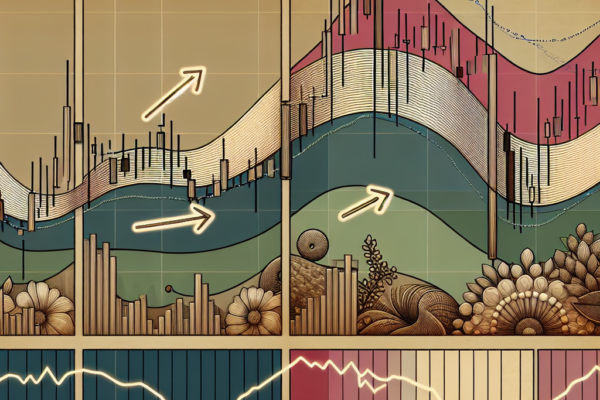

Unlocking the Bollinger Band Squeeze Strategy

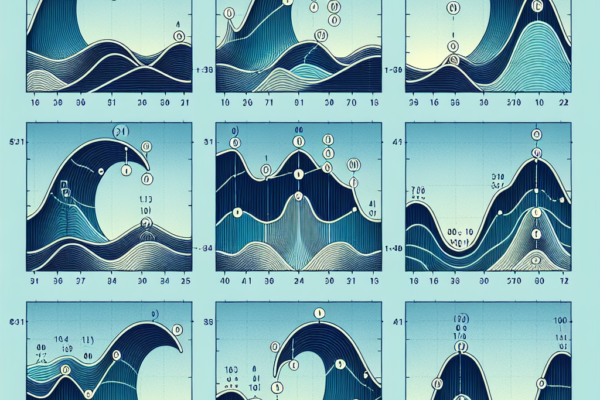

Mastering the Bollinger Band Squeeze Technique The Bollinger Band squeeze technique is a powerful tool used by traders to identify potential market breakouts. By interpreting the convergence and divergence of these bands, traders can make educated guesses on the future direction of the market. This technique, named after its creator John Bollinger, utilizes volatility and…