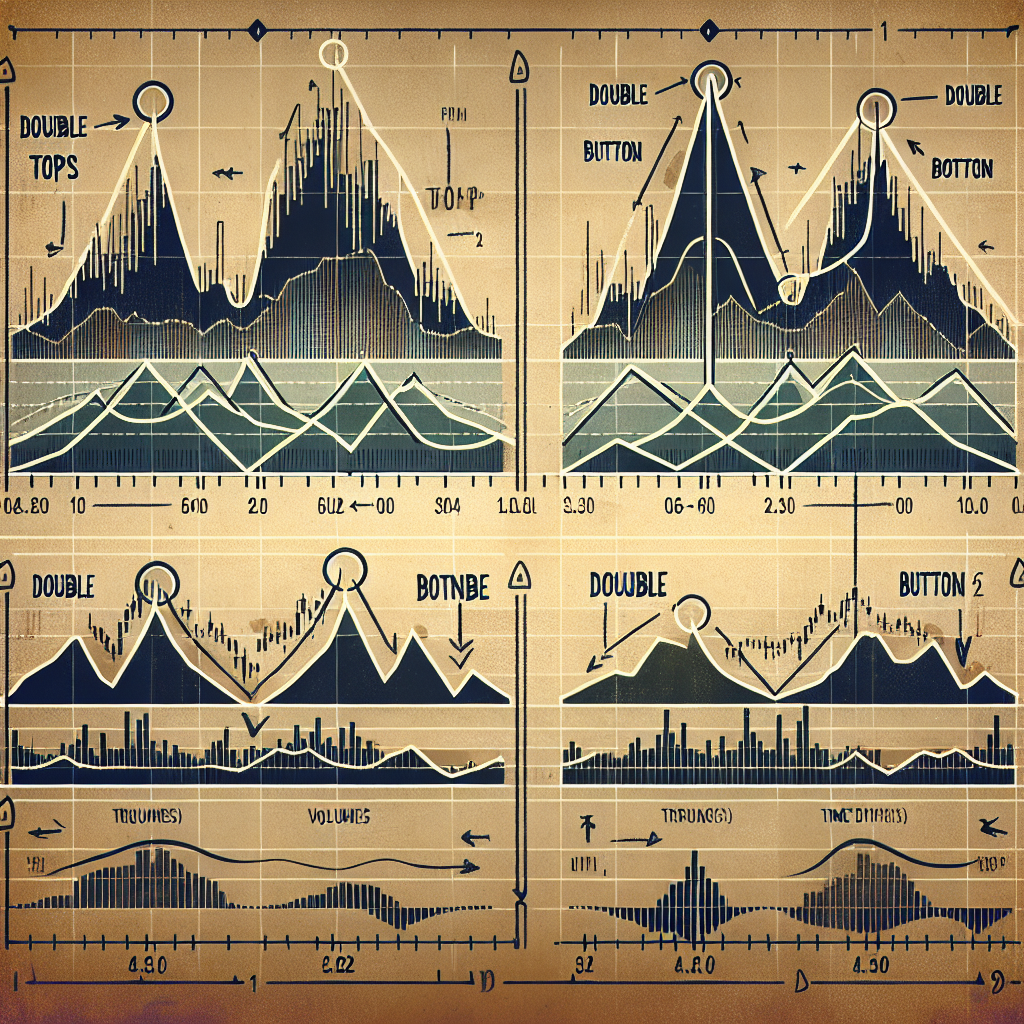

# Recognizing Double Tops and Bottoms in Market Charts

Traders and investors use various chart patterns to predict future market movements. Among the most well-known patterns are double tops and double bottoms. These patterns signify potential reversals in the market, making them invaluable tools for those looking to capitalize on shifting trends. This article provides an in-depth guide on recognizing these patterns and understanding their implications.

What are Double Tops and Bottoms?

Double tops and double bottoms are chart patterns that signal a change in market trend. They are identified by two peaks (double tops) or troughs (double bottoms) that occur at roughly the same price level. These patterns are indicative of a struggle between buyers and sellers to control the market direction, often resulting in a significant trend reversal.

Identifying Double Tops

Double tops are formed after an extended upward trend, indicating potential exhaustion of the bullish momentum and a possible shift to a bearish market.

Formation of Double Tops

– The first peak forms as the price reaches a new high in its current bull trend.

– Following the first peak, the price undergoes a minor pullback.

– The price then rises back to the level of the first peak to form the second peak.

– Importantly, the second peak does not significantly surpass the first peak, creating a resistance level.

Confirmation of Double Tops

– A key confirmation signal of a double top is the price breaking below the support level, which lies at the lowest point between the two peaks.

– Volume plays a critical role, with an increase in volume on the breakout reinforcing the pattern’s validity.

Identifying Double Bottoms

Conversely, double bottoms are identified after a prolonged downtrend, suggesting a potential end to bearish momentum and a shift towards a bullish market.

Formation of Double Bottoms

– The first trough is formed when the price hits a new low in its bear trend.

– After a minor rally, the price declines again, attempting to reach the level of the first trough but not significantly breaking below it, thus forming the second trough.

– This action creates a support level; the level the price struggles to fall below.

Confirmation of Double Bottoms

– Confirmation comes when the price breaks above the resistance level, marked by the highest point between the two troughs.

– As with double tops, volume is a key confirmation factor. An increase in volume on the price breakout further validates the pattern.

Trading Strategies Based on Double Tops and Bottoms

Recognizing the patterns is just the first step. Traders often wait for additional confirmation signals, like a breakout, before entering a trade. Stop-loss orders are commonly placed just below a double bottom or above a double top to manage risk.

Conclusion

Double tops and double bottoms are powerful chart patterns that signal potential reversals in market trends. By learning how to recognize and interpret these patterns, traders can make more informed decisions and potentially capitalize on significant market movements. As with all trading strategies, it’s important to consider other factors and indicators to validate your trading signals.