Using Moving Averages for Trend Analysis

In the realm of financial analysis, moving averages are a critical tool used to evaluate the direction of a trend. This statistical calculation helps to analyze data points by creating a series of averages of different subsets of the full data set. This article aims to shed light on the use of moving averages for trend analysis.

Understanding Moving Averages

Before we delve into the application of moving averages for trend analysis, it is essential to understand what moving averages are.

Definition of Moving Averages

A moving average (MA) is a statistical analysis tool that calculates the average price of a security, commodity, or index over a specified period. It is called a ‘moving’ average because it is recalculated frequently by incorporating the latest data and dropping the oldest one, hence ‘moving’ over time.

Types of Moving Averages

The two most common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA is calculated by adding the price of an instrument over a number of time periods and then dividing the sum by the number of time periods. The EMA, on the other hand, gives more weight to the most recent prices, which can make it more responsive to new information.

Using Moving Averages for Trend Analysis

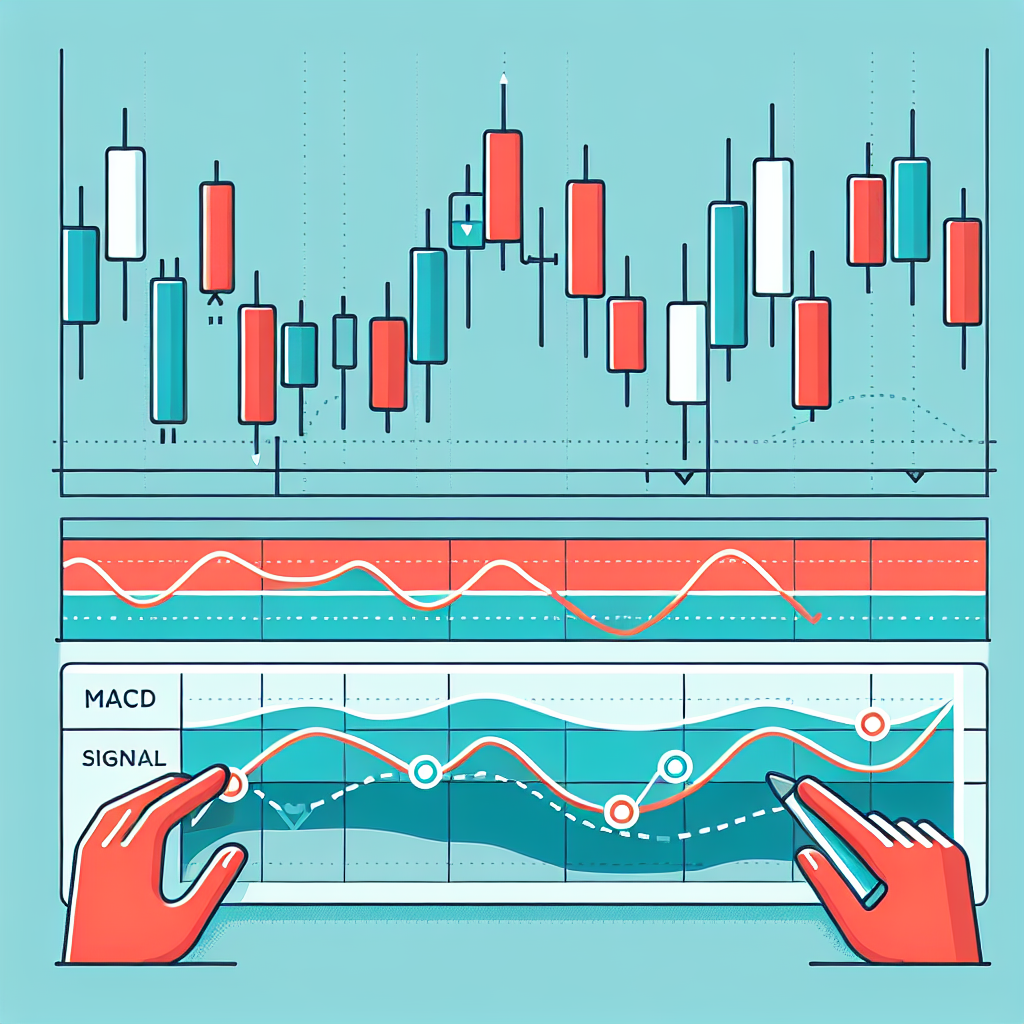

Moving averages are primarily used to identify trend direction, but they can also be used to generate potential buy and sell signals.

Identifying Trend Direction

A moving average can help cut through the noise of fluctuating price data to identify a trend. For example, if a security’s price is steadily increasing, its moving average will rise, and if a security’s price is steadily decreasing, its moving average will fall. If the price is fluctuating without any particular trend, the moving average will remain relatively flat.

Generating Buy and Sell Signals

Moving averages can also be used to generate buy and sell signals. A common strategy is to buy when the price crosses above the moving average and sell when it crosses below the moving average. However, this strategy should be used with caution, as it can produce false signals if the market is range-bound rather than trending.

Conclusion

Moving averages are a powerful tool for trend analysis, offering a simplified view of market direction and generating potential trading signals. However, like all technical analysis tools, they should not be used in isolation. Traders should consider other factors and indicators before making trading decisions. Despite their limitations, moving averages can provide valuable insights into market trends, helping traders make more informed decisions.