Understanding Advanced Candlestick Patterns

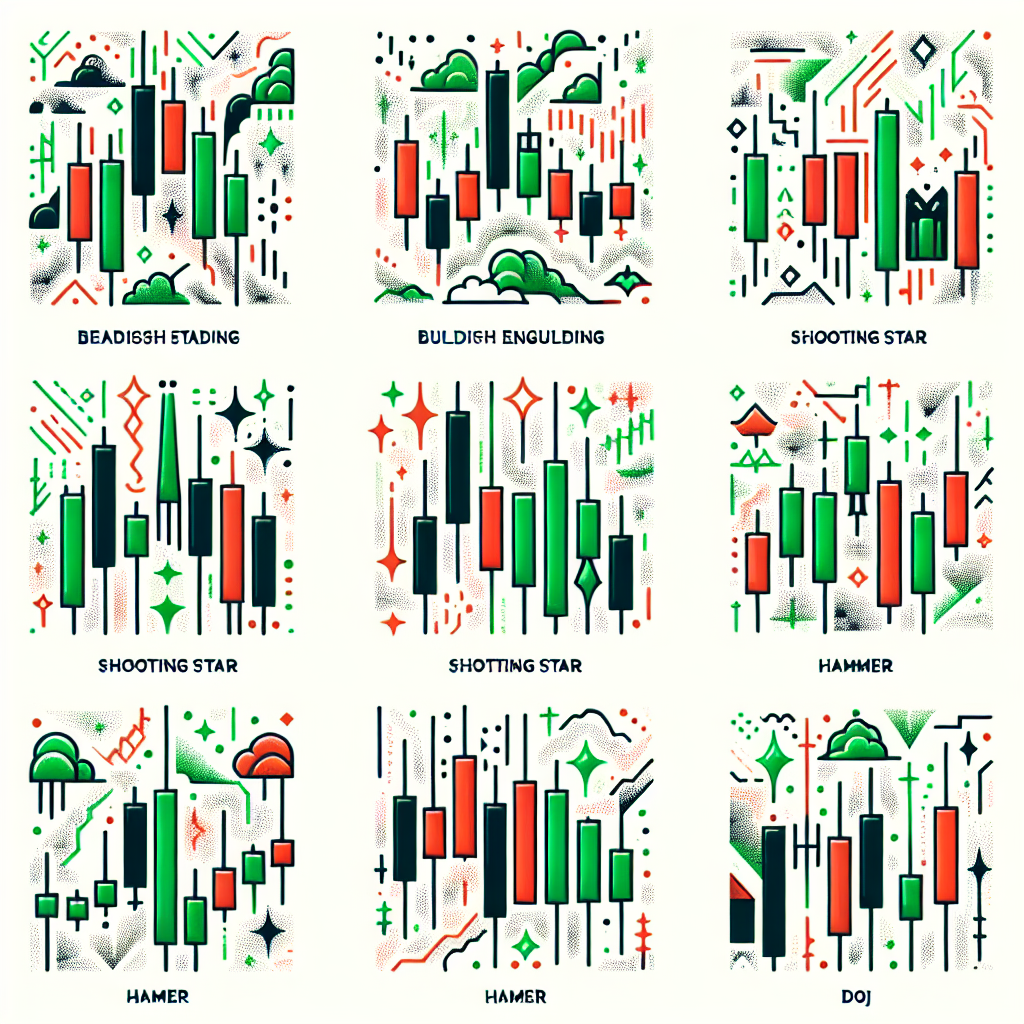

Candlestick patterns are an essential tool in the toolkit of every trader. They provide a visual representation of market activity, revealing potential market reversals and continuations. Although there are many simple candlestick patterns, this article will focus on more advanced patterns that can provide deeper insights into market dynamics.

Introduction to Advanced Candlestick Patterns

Advanced candlestick patterns are formed by three or more candles. They provide more information about the market sentiment than simple patterns, making them more reliable. However, they are also more complex and require a deeper understanding of candlestick charting.

Three Black Crows

Identification

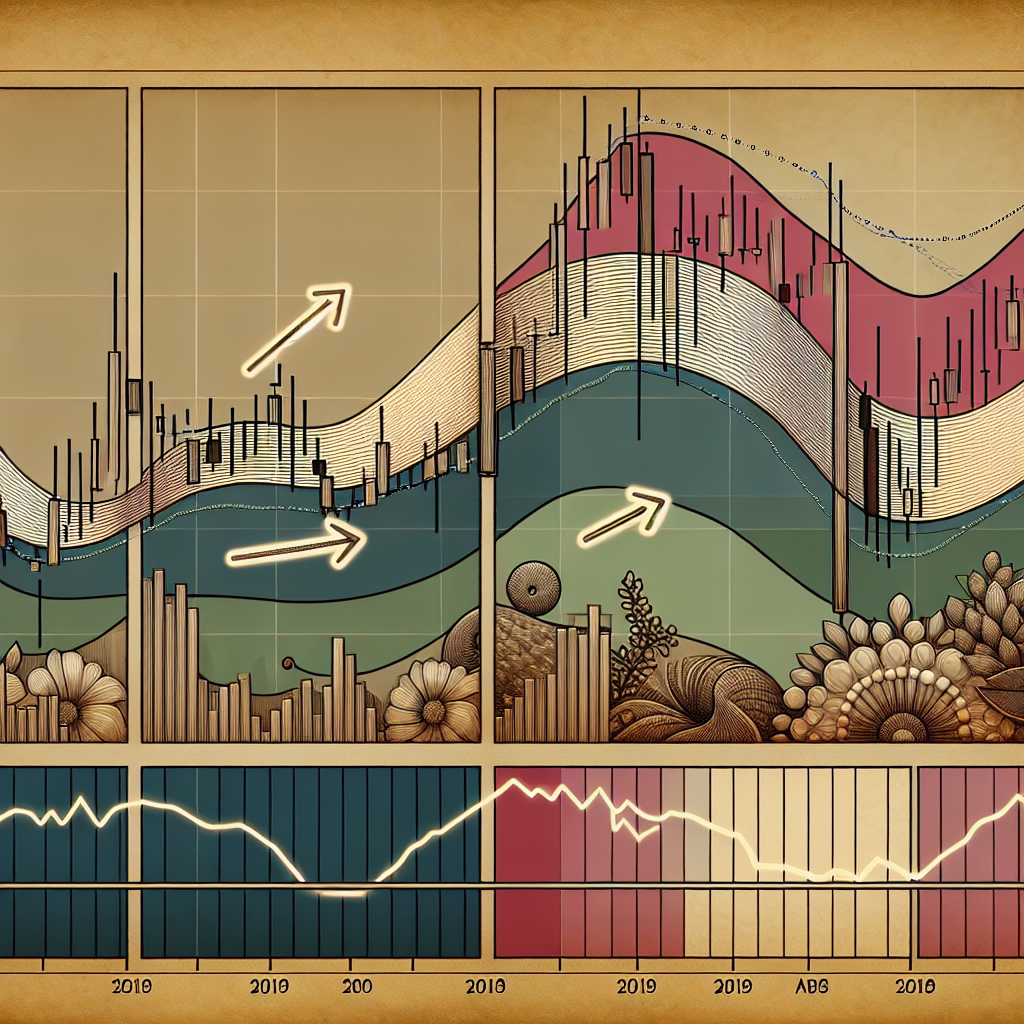

The Three Black Crows pattern is a bearish reversal pattern that appears at the end of an uptrend. It consists of three consecutive long-bodied candles that have opened within the body of the previous candle and closed lower than the previous one.

Interpretation

The Three Black Crows pattern suggests that the bears have taken control of the market and that the price is likely to continue falling. Traders should look for confirmation from other technical indicators or chart patterns before entering a trade.

Three White Soldiers

Identification

The Three White Soldiers pattern is the bullish counterpart of the Three Black Crows. It is formed by three consecutive long-bodied candles that have opened within the body of the previous candle and closed higher than the previous one.

Interpretation

The Three White Soldiers pattern indicates that the bulls have taken over the market and that the price is likely to continue rising. Like with the Three Black Crows, traders should seek confirmation before entering a trade.

Evening Star

Identification

The Evening Star is a bearish reversal pattern that appears at the end of an uptrend. It is formed by a long bullish candle, followed by a small-bodied candle (the star) that has gapped away from the previous candle, and a long bearish candle that closes within the body of the first candle.

Interpretation

The Evening Star pattern suggests that the bulls are losing control and that the bears are ready to take over. The pattern is confirmed when the third candle closes below the midpoint of the first candle.

Morning Star

Identification

The Morning Star is the bullish counterpart of the Evening Star. It appears at the end of a downtrend and is formed by a long bearish candle, followed by a small-bodied candle (the star) that has gapped away from the previous candle, and a long bullish candle that closes within the body of the first candle.

Interpretation

The Morning Star pattern indicates that the bears are losing control and that the bulls are ready to take over. The pattern is confirmed when the third candle closes above the midpoint of the first candle.

Final Thoughts

Advanced candlestick patterns can provide valuable insights into market dynamics, but they should not be used in isolation. Combining them with other technical analysis tools can increase their reliability and help traders make more informed decisions. It’s also crucial to remember that no pattern can guarantee future price movements, and risk management should always be a priority.