Finding Reliable Support Levels

In the world of trading and investing, understanding support and resistance levels is crucial. These levels help traders make informed decisions about when to buy, sell, or hold a particular asset. This article will focus on finding reliable support levels, which are essentially the price levels at which demand is strong enough to prevent the price from falling any further.

Understanding Support Levels

Support levels are a key concept in technical analysis, a method of predicting future price movements based on historical price data and statistics. The support level is the price level at which an asset’s price tends to stop falling because of increased demand or buying interest. As the price drops towards the support level, it is believed that demand will increase and help to stabilize the price.

How to Identify Support Levels

Step 1: Use Historical Price Data

The first step to identifying support levels is to look at the historical price data of the asset you’re interested in. This can be done using a price chart, which will show you the asset’s price movements over time. Look for levels where the price has stopped falling and started to rise on multiple occasions – these are potential support levels.

Step 2: Use Trend Lines

Trend lines can also help identify support levels. A trend line is a line drawn on a price chart that connects multiple low points. The line represents a level at which the price has found support multiple times in the past, and may do so again in the future.

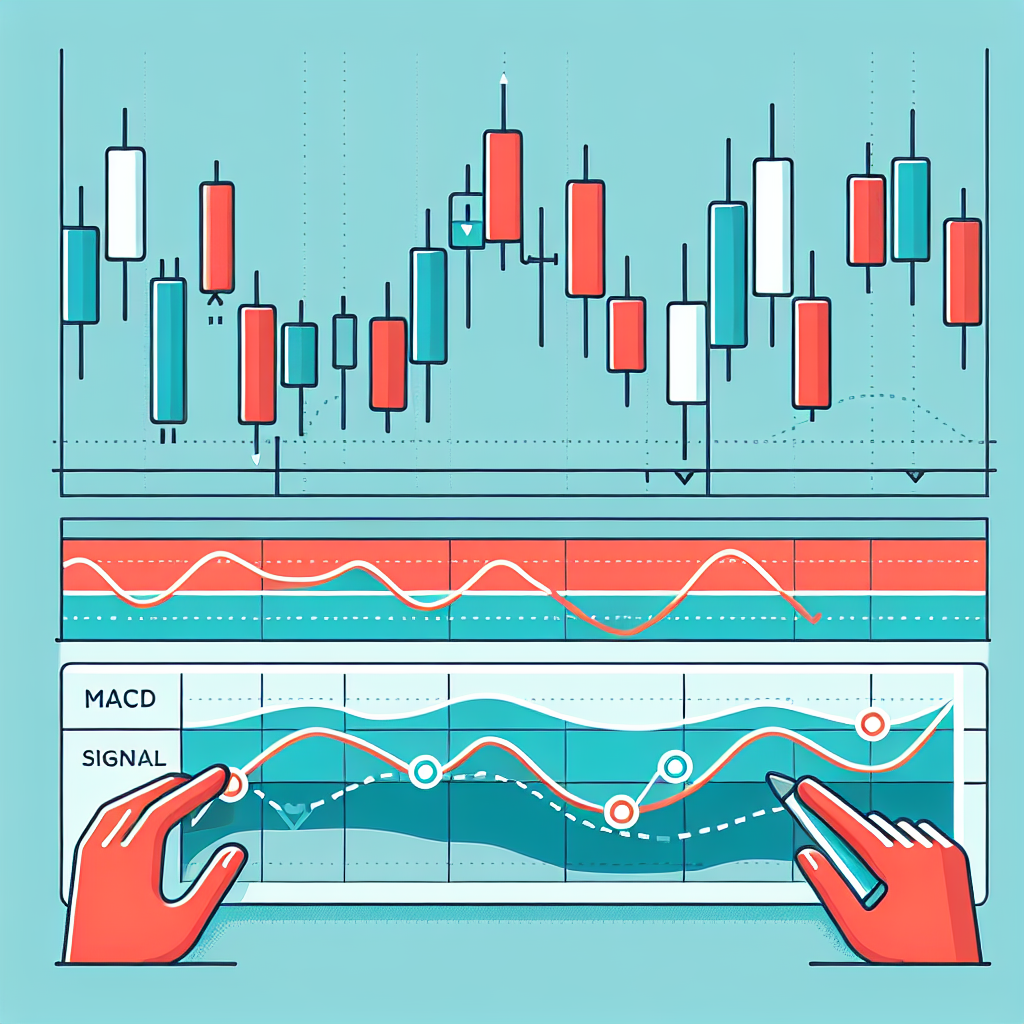

Step 3: Use Moving Averages

Moving averages, which average out a certain number of past price points, can also act as support levels. If the price of an asset is above its moving average, the moving average can act as a support level.

Importance of Reliable Support Levels

Reliable support levels are important for several reasons. Firstly, they can help traders identify potential buying opportunities. If the price of an asset is approaching a known support level, it might be a good time to buy, as the price is likely to bounce back up.

Secondly, support levels can also help traders manage their risk. If the price breaks below a support level, it’s a signal that the asset may be entering a downtrend, and it might be a good time to sell or short the asset.

Conclusion

In conclusion, finding reliable support levels is a crucial part of technical analysis and can help traders make more informed decisions. By using historical price data, trend lines, and moving averages, you can identify these levels and use them to guide your trading strategy. However, it’s important to remember that no method is foolproof, and all trading decisions should be made in conjunction with other research and analysis.