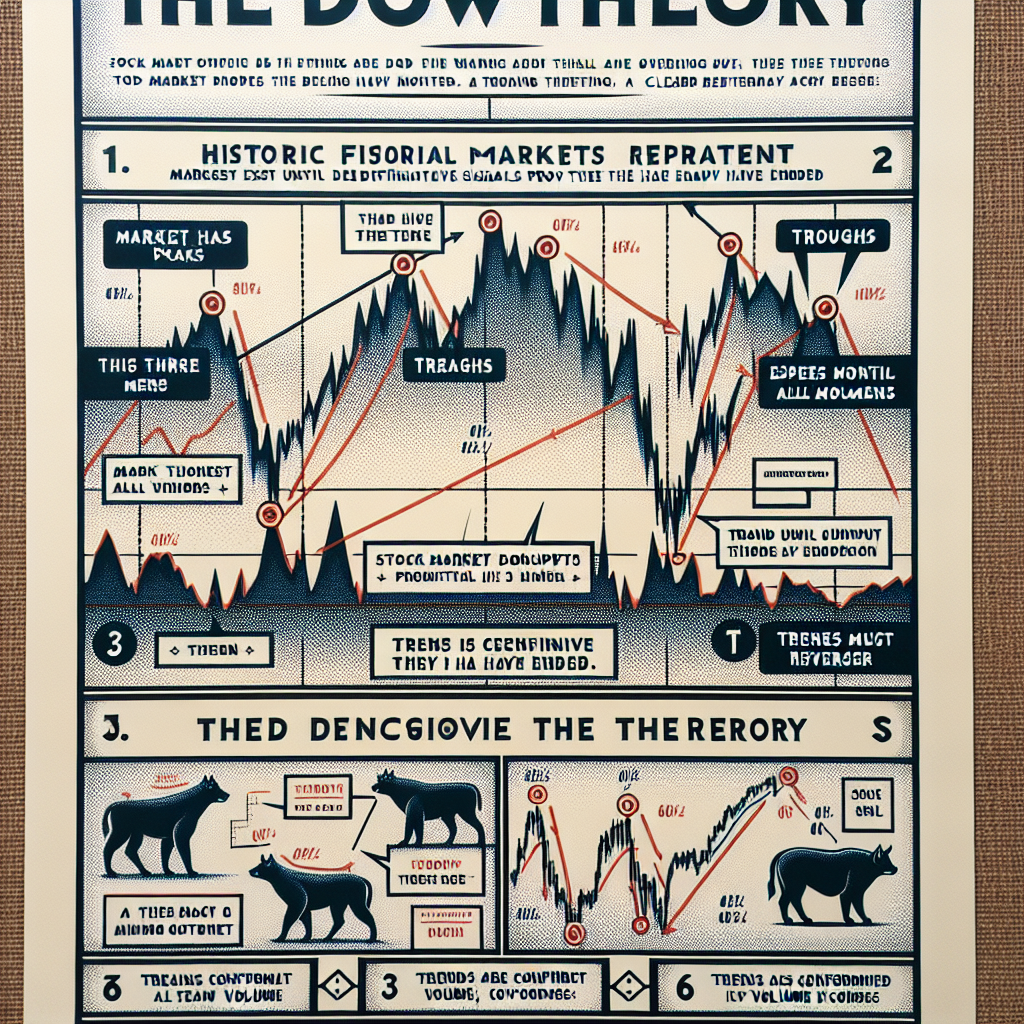

Applying Dow Theory to Modern Markets

Introduction to Dow Theory

Dow Theory is a fundamental concept in technical analysis, which was derived from the writings of Charles Dow, the founder of The Wall Street Journal and co-founder of Dow Jones and Company. The theory is based on six basic tenets and is primarily used to identify and confirm trends in the stock market. While Dow Theory was formulated more than a century ago, its principles remain relevant and applicable to modern markets, including forex, commodities, and cryptocurrencies.

The Six Tenets of Dow Theory

Before applying Dow Theory to modern markets, it’s essential to understand its six fundamental principles:

The Market Discounts Everything

According to Dow Theory, everything that can affect the market, including economic data, political events, and natural disasters, is already factored into the market price. Thus, the current price is a reflection of all known information.

There are Three Types of Market Trends

Dow Theory identifies three types of trends in the market: primary (long-term), secondary (medium-term), and minor (short-term). Each of these trends can be bullish (upward) or bearish (downward).

Primary Trends Have Three Phases

The primary trend has three phases: accumulation, public participation, and distribution. The accumulation phase is when informed investors start to buy, the public participation phase is when the majority of traders join the trend, and the distribution phase is when informed investors start to sell.

Stock Market Indexes Must Confirm Each Other

In Dow’s time, this meant that the industrial and rail averages must confirm each other. In today’s context, it could mean that a similar movement should be observed in related sectors or indexes.

Volume Must Confirm the Trend

Volume should increase in the direction of the primary trend. For example, in a bull market, volume should increase when prices rise and decrease when prices fall.

Trends Exist Until Definitive Signals Prove They Have Ended

According to Dow Theory, a trend remains in effect until there is a clear sign that the trend has reversed.

Applying Dow Theory to Modern Markets

Identifying Trends

Applying Dow Theory in modern markets involves identifying the primary, secondary, and minor trends. Traders can use technical analysis tools like trend lines, moving averages, and momentum oscillators to identify these trends.

Confirming Trends

Traders can confirm trends by looking at volume and related sectors or indexes. For example, in a bull market, a trader can confirm the trend if the volume is increasing when prices are rising and if related sectors or indexes are also in an uptrend.

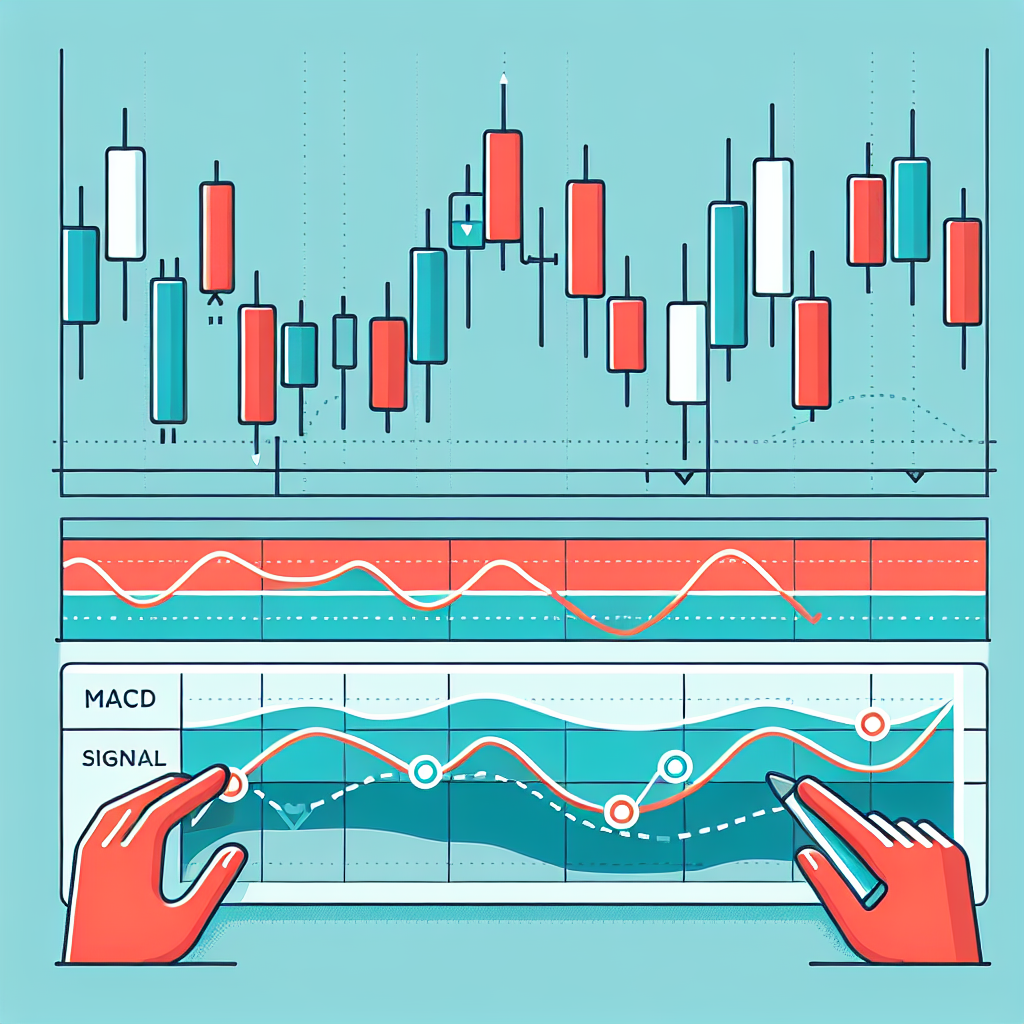

Recognizing Trend Reversals

Dow Theory can also be used to recognize trend reversals. A trend is considered to be reversed if the price falls below the previous low in an uptrend or rises above the previous high in a downtrend.

Conclusion

While Dow Theory was developed in the context of early 20th century markets, its principles remain relevant to modern markets. By understanding and applying the six tenets of Dow Theory, traders can gain insights into market trends and make more informed trading decisions. However, like all trading strategies, Dow Theory should be used in conjunction with other tools and techniques to increase the chances of success.