Understanding RSI Divergence for Trade Entry

In the world of trading, the Relative Strength Index (RSI) is a vital tool that helps traders in making informed decisions. One of the ways traders use the RSI is by looking at divergences, which can be a powerful signal for a potential change in price direction. This article will delve into the concept of RSI divergence, how it can be used for trade entry, and its significance in trading.

What is RSI Divergence?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It is typically used to identify overbought or oversold conditions in a market.

Defining Divergence

Divergence occurs when the price of an asset is moving in the opposite direction of a technical indicator, such as the RSI. This discrepancy can signal a potential reversal in the price trend. There are two types of RSI divergence: bullish and bearish.

Bullish Divergence

Bullish divergence occurs when the price of an asset is making new lows while the RSI is failing to reach new lows. This suggests that the downward trend is losing momentum and a potential bullish reversal could be on the horizon.

Bearish Divergence

Bearish divergence, on the other hand, happens when the price is making new highs while the RSI is failing to reach new highs. This indicates that the upward trend is losing steam and a potential bearish reversal could be imminent.

Using RSI Divergence for Trade Entry

Understanding RSI divergence is one thing, but knowing how to apply it to your trading strategy is another. Here are some steps on how to use RSI divergence for trade entry.

Step 1: Identify Potential Divergence

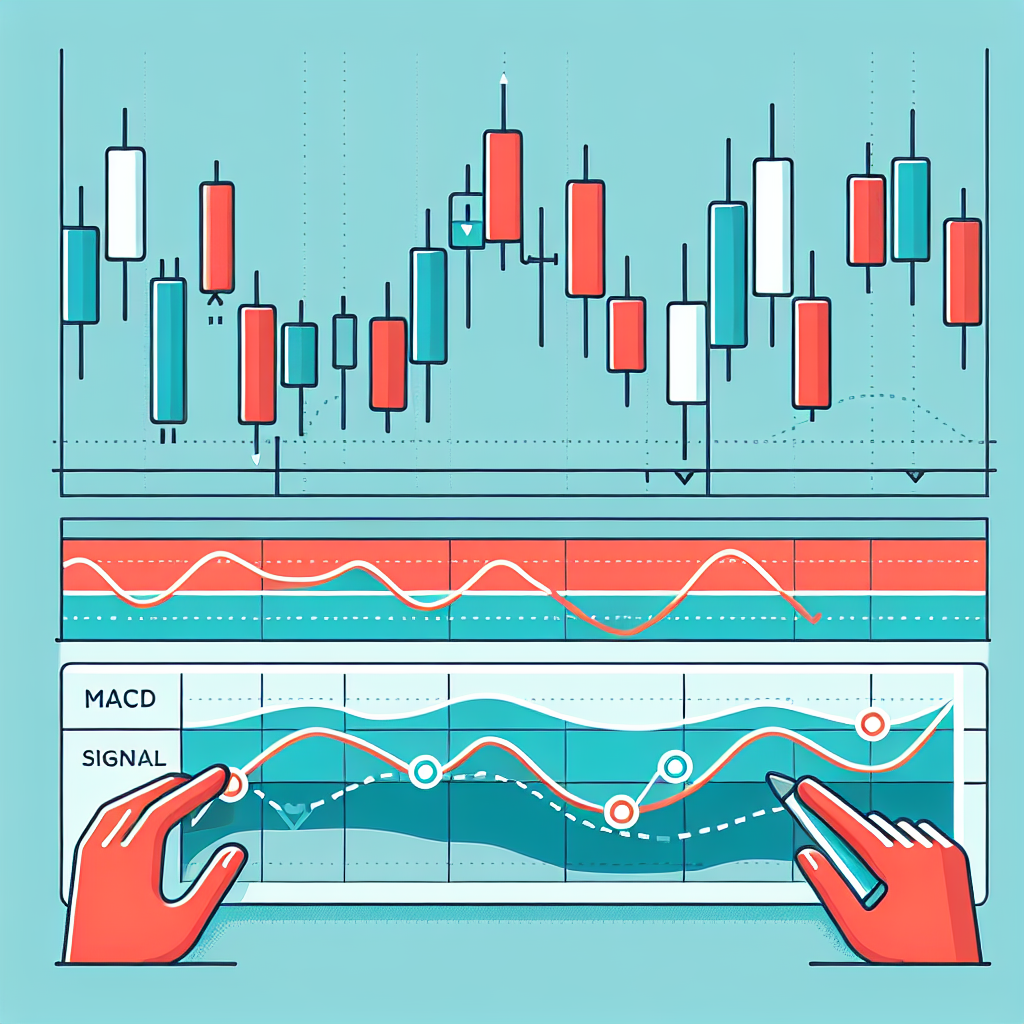

The first step is to identify a potential divergence between the price and the RSI. This means looking for instances where the price and the RSI are not moving in the same direction.

Step 2: Confirm the Divergence

Once you’ve identified a potential divergence, the next step is to confirm it. This can be done by using other technical indicators or by waiting for a price action confirmation, such as a break in trendline.

Step 3: Enter the Trade

After confirming the divergence, the next step is to enter the trade. If you’ve identified a bullish divergence, you might consider entering a long position. Conversely, if you’ve spotted a bearish divergence, you might consider entering a short position.

The Significance of RSI Divergence in Trading

RSI divergence is a powerful tool in a trader’s arsenal. It can provide early warning signs of potential price reversals, allowing traders to get in or out of trades at optimal points. However, like all trading strategies, it’s not foolproof and should be used in conjunction with other technical analysis tools and indicators.

In conclusion, understanding and using RSI divergence effectively can significantly enhance a trader’s ability to make informed trading decisions. It provides valuable insights into market conditions and potential trend reversals, making it a vital tool for any trader.