Trading with MACD Crossovers

Introduction

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It is used to identify potential buy and sell signals, with one of the most popular methods being the MACD crossover. In this article, we will delve into how to trade with MACD crossovers, providing a comprehensive guide for both beginners and seasoned traders.

Understanding MACD

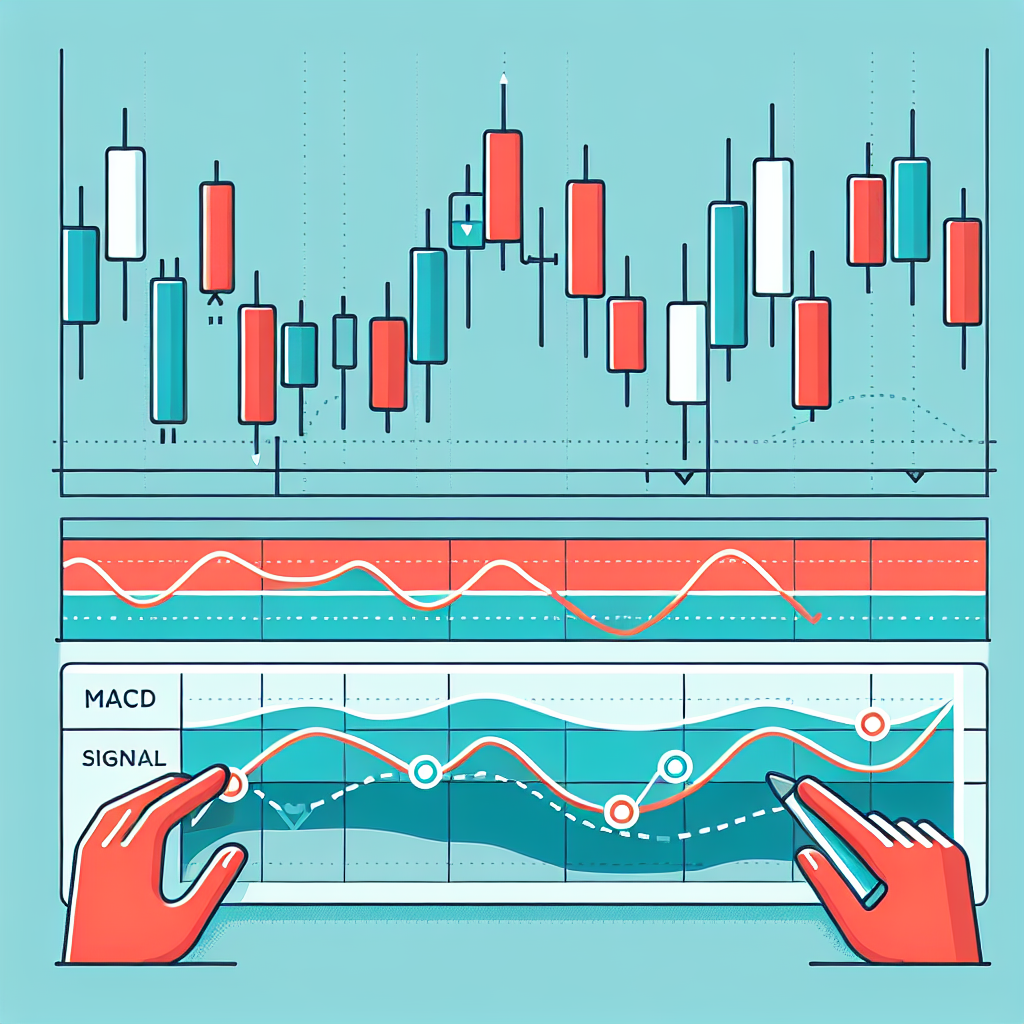

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of this calculation is the MACD line. A nine-day EMA of the MACD, called the “signal line,” is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals.

The MACD Crossover

What is a MACD Crossover?

A MACD crossover occurs when the MACD line and the signal line cross each other on the MACD histogram. There are two types of MACD crossovers: the bullish crossover and the bearish crossover.

Bullish Crossover

A bullish crossover happens when the MACD line crosses above the signal line. This is considered a bullish (buy) signal, indicating that it may be a good time to buy the security.

Bearish Crossover

A bearish crossover, on the other hand, happens when the MACD line crosses below the signal line. This is considered a bearish (sell) signal, indicating that it might be a good time to sell the security.

Trading with MACD Crossovers

Step 1: Identify the MACD Crossover

The first step in trading with MACD crossovers is to identify when a crossover occurs. This can be done by closely monitoring the MACD histogram and waiting for the MACD line to cross the signal line.

Step 2: Confirm the Signal

Once a crossover has been identified, it’s important to confirm the signal before making a trade. This can be done by looking at other indicators or the overall market trend. If other indicators support the MACD crossover signal, it may be a good time to make a trade.

Step 3: Make a Trade

After confirming the signal, the next step is to make a trade. If a bullish crossover occurs, this might be a good time to buy. Conversely, if a bearish crossover occurs, this might be a good time to sell.

Conclusion

MACD crossovers can be a useful tool for traders, helping to identify potential buy and sell signals. However, like all trading strategies, they should not be used in isolation. It’s important to consider other technical indicators and the overall market trend when making trading decisions. With practice and experience, trading with MACD crossovers can become a valuable part of a trader’s toolkit.