Cyclical Analysis in Trading

Introduction

Trading in financial markets is a complex activity that requires a comprehensive understanding of several factors that influence price movements. One of the most effective methods of predicting future price trends is through cyclical analysis. This article will delve into the intricate world of cyclical analysis in trading, explaining its concept, importance, and how it is used in trading strategies.

Understanding Cyclical Analysis

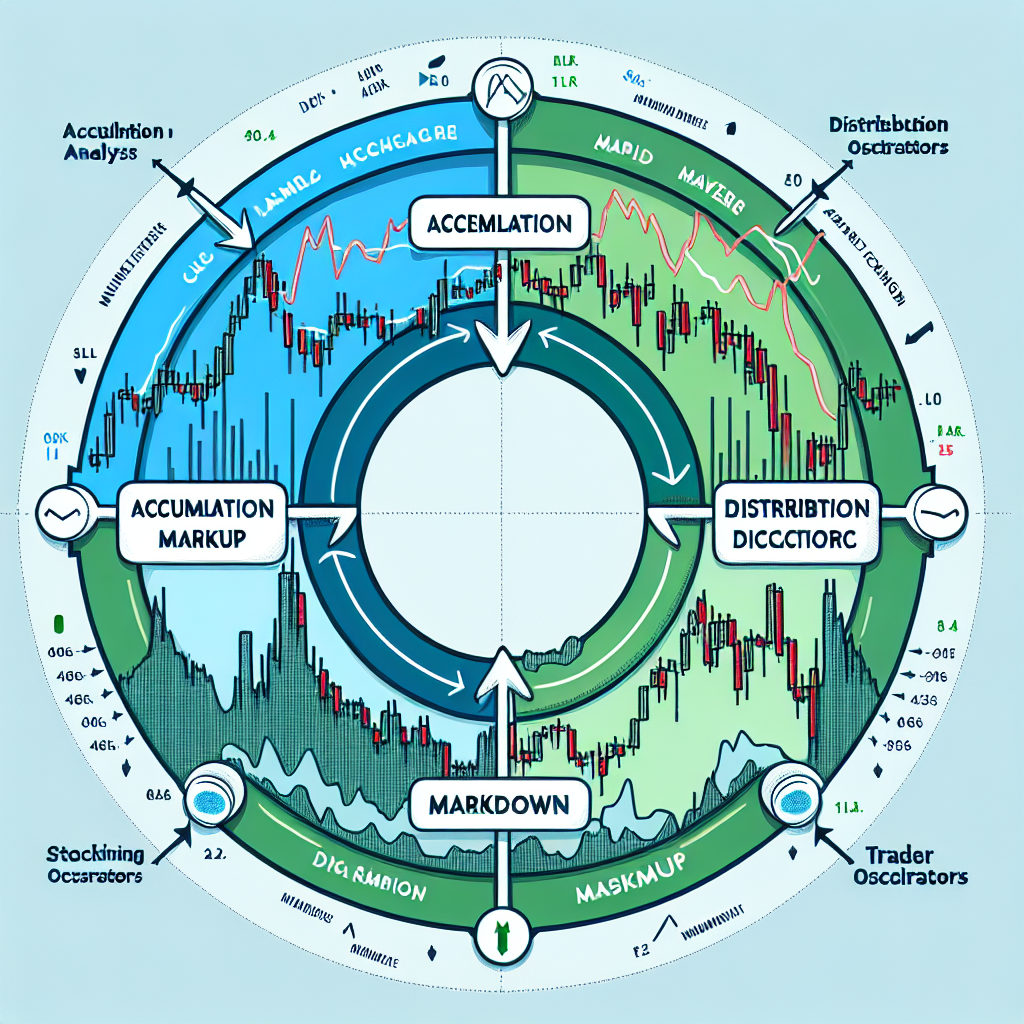

Cyclical analysis is a type of technical analysis where price movements are predicted based on the observation of recurring patterns or cycles. These cycles are often driven by a myriad of factors, including economic conditions, investor sentiment, and political events. Traders and investors use cyclical analysis to identify possible turning points in the market, thus guiding their buying and selling decisions.

Types of Cycles

There are several types of cycles that traders analyze, including:

- Seasonal cycles: These are patterns that occur at specific times of the year. For example, retail stocks often rise during the holiday shopping season.

- Economic cycles: These are patterns related to the overall economy, such as recession and expansion cycles.

- Business cycles: These are patterns related to specific industries or companies. For example, the tech industry might have its own unique cycle.

The Importance of Cyclical Analysis in Trading

Cyclical analysis is crucial in trading for several reasons. First, it allows traders to forecast potential price movements, thus providing a basis for decision making. It also helps traders identify the best times to enter or exit a trade, maximizing their potential profits and minimizing risks. Lastly, cyclical analysis can be used in conjunction with other forms of analysis to provide a more holistic view of the market.

Using Cyclical Analysis in Trading Strategies

Implementing cyclical analysis in trading involves identifying and analyzing the recurring patterns in price movements. Here is a step-by-step guide on how to use cyclical analysis in your trading strategy:

Step 1: Identify the Cycle

The first step in cyclical analysis is identifying the cycle. This involves observing the market over a period of time and noting the recurring patterns in price movements. The duration of these cycles can vary from short-term cycles that last a few days to long-term cycles that last several years.

Step 2: Analyze the Cycle

Once the cycle has been identified, the next step is to analyze it. This involves studying the characteristics of the cycle, such as its duration, amplitude (the range of price movement), and phase (the current stage of the cycle). This analysis will help you predict future price movements.

Step 3: Implement the Analysis

After analyzing the cycle, the final step is to implement this analysis into your trading strategy. This might involve buying when the cycle is at its low point and selling when it is at its high point. Alternatively, you might choose to trade against the cycle if you believe it is about to reverse.

Conclusion

Cyclical analysis is a powerful tool in the arsenal of any trader. By understanding and predicting the cyclical nature of the markets, traders can make more informed decisions and potentially increase their profits. However, like any other trading strategy, cyclical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management techniques.